We Were Wrong About Copper

Adjusting the time horizon.

At the beginning of May, we wrote an article titled “A Copper Super-Cycle”, explaining why we thought the metal could outperform in the mid-term.

Although prices did rally for several weeks after our article, we saw a sharp retracement over the summer (shown below). Yet, with copper up 4.5% so far in September and being pushed to two-month highs thanks to the Fed from Wednesday night, it left us thinking. Were we actually wrong about our copper call, or were we simply just a few months too early?

Today, we discuss reasons why we still like copper, some of the factors that we didn’t accurately forecast this summer, and distinguishing between the short-term and long-term time horizons.

Why We Like Copper

There are several reasons why we thought the mid- and long-term outlook for copper was rosy, and these reasons haven’t changed.

Renewable Energy

Copper is a critical material in electric vehicles (EVs) due to the unique range of properties such as electrical conductivity, durability, and ability to handle high thermal loads.

An EV uses up to three times more copper than a conventional internal combustion engine vehicle, primarily for its battery, motor, wiring, and inverters.

Copper is crucial for efficient energy flow between the vehicle’s components, especially in the high-voltage systems that power EVs. EV adoption is only going to increase further in the coming year(s), supporting the growth of the EV battery market, as the chart below highlights.

As EV adoption increases, copper demand will rise significantly, reinforcing its importance in the future of transportation.

Global Infrastructure

Given the properties about copper we’ve already mentioned, it makes use of the metal appealing in construction, transportation, and energy systems.

In power generation and distribution, copper’s electrical conductivity makes it the primary material for wiring, transformers, and power cables. As countries upgrade ageing grids to accommodate renewable energy sources, the demand for copper in these systems is expected to rise significantly.

Additionally, copper is used in the construction of buildings, especially in plumbing, heating, and cooling systems, as well as in the wiring of modern smart buildings that require complex electrical systems. The metal's ability to resist corrosion and handle high temperatures also makes it ideal for industrial equipment and machinery, which are important in large-scale infrastructure projects like transportation networks, ports, and bridges.

The surge in global infrastructure investments, particularly in emerging markets like India and Africa, as well as developed economies like the U.S. and China, is likely to drive a long-term increase in copper demand. For example, the U.S. is undergoing significant infrastructure modernisation under initiatives like President Biden's $1.2 trillion infrastructure bill, which will fund projects for roads, bridges, electric grids, and broadband expansion—all of which require substantial amounts of copper.

Similarly, China's Belt and Road Initiative is a massive infrastructure project spanning multiple continents, demanding high volumes of copper for railways, ports, and energy grids.

Supply Issues

We appreciate that oversupply has been a key factor in the summer slump in the price of copper. We’ll discuss this shortly, but we feel excess supply isn’t a long-term factor in play. Rather, supply issues could help to push the price higher, not lower, further down the line.

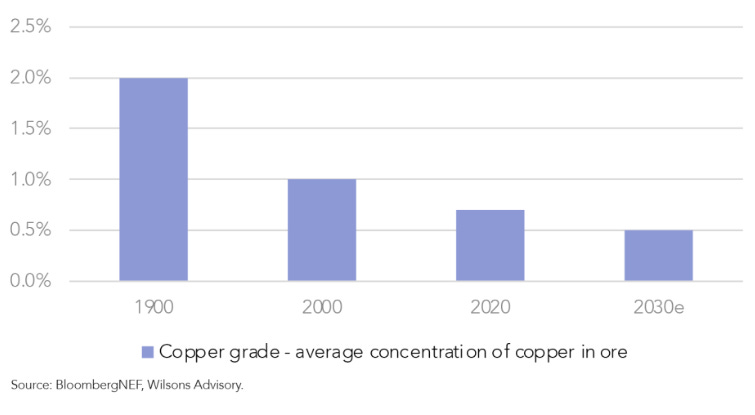

Many of the world’s largest copper mines are ageing, and the copper content (ore grade) is decreasing, making extraction more difficult and expensive. This lowers the overall supply of copper, as more effort and cost are required to produce the same amount of the metal. Note the below chart, whereby the copper grade is expected to halve from the period between 2020 and 2030 (using data released late 2023).

Although more of a longer-term issue, we flag up an interesting comment from a Bloomberg piece that we read recently:

“Mined copper supply growth could falter by the middle of the decade as regulatory approvals become more protracted, which means supply could lag behind robust decarbonisation demand. Market deficits at the end of the decade look likely unless the miners can speed up their development.”

The Summer Slump

In the short term, the summer certainly didn’t play out the way we initially thought.