What Happens When Liquidity Dries Up?

Lower liquidity is having an impact this week.

The interconnected concepts of liquidity and volatility are likely to be familiar and well-understood by experienced traders. However, it’s important to not only have a comprehensive understanding of these terms but also to know how to implement them effectively in a trading strategy.

Liquidity

Liquidity measures the ease and speed at which an asset can be bought or sold in the market. It is an essential metric for gauging the market’s depth and efficiency.

In all markets, liquidity plays a vital role in executing trades quickly and efficiently, especially for large orders. For example, in forex markets, buying EURUSD at 1.07 involves buying the Euro and selling the U.S. dollar simultaneously. Despite the complexity of the transaction, the order can be executed almost instantaneously, thanks to the market’s high liquidity.

All trades are zero-sum, meaning that for every buyer, there must be a seller. Therefore, the market’s liquidity ensures that there is always a counterparty willing to sell the Euro at 1.07, making it easier for buyers to enter and exit the market without worrying about liquidity.

Relationship with volatility

Research has consistently shown that lower levels of liquidity are associated with higher levels of volatility. This relationship can be attributed to several factors:

Increased Information Asymmetry: In low-liquidity markets, there is a greater imbalance between informed and uninformed investors. This information asymmetry can lead to more aggressive trading behaviour as market participants try to take advantage of superior knowledge. This increased activity can amplify price movements, resulting in higher volatility.

Lack of Market Making: In illiquid markets, fewer market makers are willing to provide liquidity and quote prices. As a result, market participants may be forced to trade at less favourable prices or wait for better opportunities, leading to larger price swings.

Increased Risk Premium: Investors in low-liquidity markets often demand a higher risk premium to compensate for the increased uncertainty associated with trading in such environments. This can lead to higher expected returns but also increases the likelihood of large price movements.

Illiquidity

A lack of liquidity in a market has an effect. The lack of ready buyers leads to larger discrepancies between the asking price, set by the seller, and the bid price, submitted by the buyer. This difference leads to larger bid-ask spreads than would be found in an orderly market with daily trading activity. The lack of depth of the market (DOM), or ready buyers, can cause holders of illiquid assets to experience losses, especially when the investor is looking to sell quickly.

The current volatility in cocoa futures is an example.

The rally of futures has resulted in a 160% increase this year, mainly due to inadequate West African harvests leading to a global shortage of beans. An in-depth article was posted about this dynamic last month:

Back To The Cocoa Futures

This week, the spotlight isn't on altcoins or AI-related stocks. Instead, all eyes are on cocoa futures. Cocoa futures surged past $10,000 per metric ton on Tuesday, marking an unprecedented milestone and representing a remarkable 140% increase for the year. During Monday’s trading alone, futures prices escalated by $710 per metric ton, establishing a new record for the largest one-day change.

However, the surge in prices has caused higher costs for holding positions, forcing investors to exit trades. This has resulted in reduced liquidity, making the market more susceptible to significant price fluctuations.

The rise in Cocoa prices this year has resulted in traders, along with those who have hedged against physical holdings, having to put up additional funds to cover margin calls. These calls act as a safety net to protect against any potential losses. However, if traders are unable to meet these obligations, they are forced to close their positions, leading to a decrease in open interest, reduced liquidity and increased volatility.

Lower liquidity in the Japanese yen has seen the currency start this week with extreme volatility.

On Monday afternoon, the yen made a recovery to 155.07 against the dollar after a previous dip past 160 that brought it to its lowest point since April 1990. Trading volumes were thin as it was a public holiday in Japan. The large price swings lower were the result of low liquidity — a lack of buyers. The quick move to 155 was (likely) intervention from the MOF.

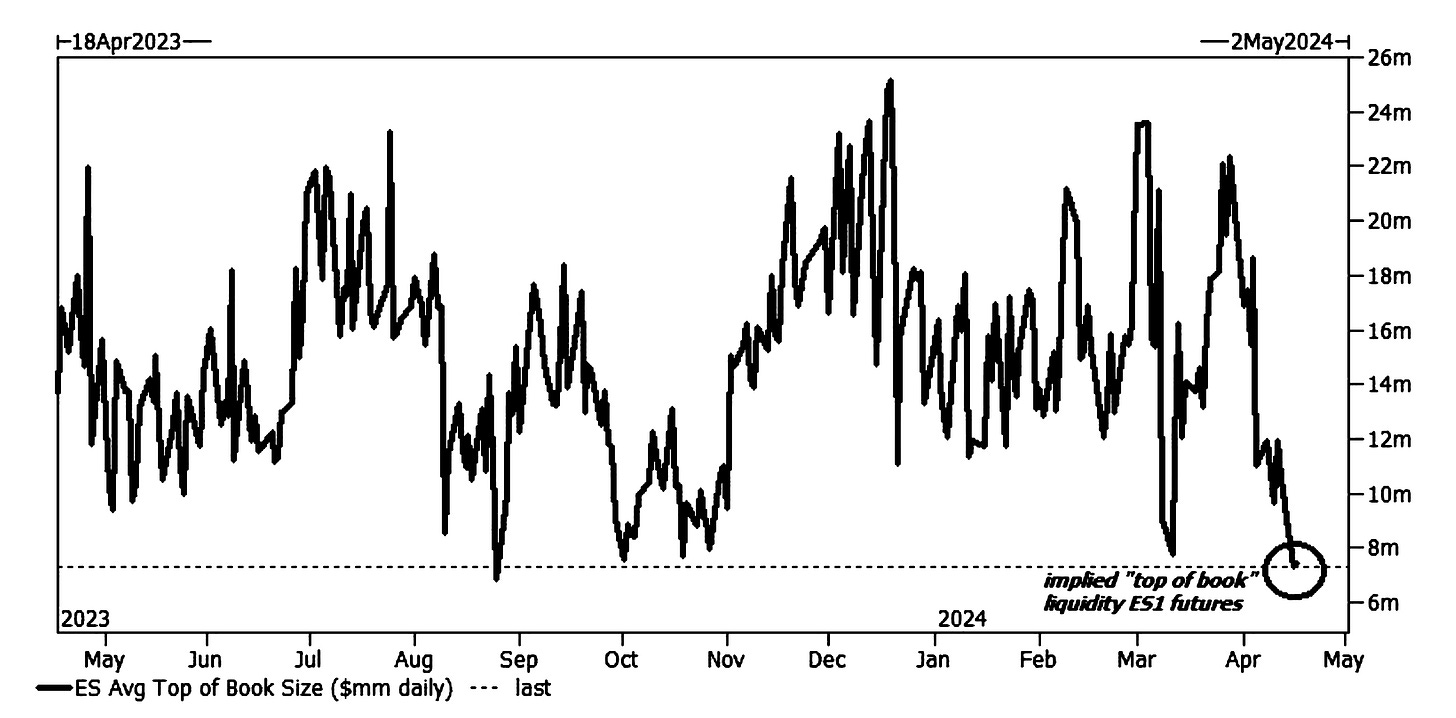

Trading low equity liquidity

In light of the correlation between liquidity and volatility, it is advisable to exercise caution and be more discerning when selecting trades during periods of lower liquidity. This is particularly relevant at present, given the current state of S&P 500 futures.