Whose Put Is It Anyway?

The "Trump Put" has bypassed markets, and the FOMC is all about uncertainty.

There is a growing fear among market participants that Donald Trump’s tolerance for equity market weakness is much higher than in his first term. Many had bet the President would retreat from his most severe tariff threats and federal government cuts if markets responded violently. Still, these investors are losing faith that financial markets will restrain the U.S. President’s plans. The so-called “Trump Put” remains an unlikely hope.

Alongside markets falling 10% over the last month, data prints have been released that warrant concern over a potential “growth scare”—yet not necessarily an impending disaster. The Citi Economic Surprise Index, which tracks the gap between expectations and reality of economic performance, has plummeted to its lowest level since September 2024, indicating data are coming in well below economists’ expectations. The Purchasing Managers’ Index (PMI) of activity in the U.S. services sector fell into contraction for the first time in over two years. Finally, the Conference Board’s index of leading economic indicators dipped below forecasts.

Sentiment has turned in the sense that there are clear signs that the Trump put either doesn’t exist or is set lower than where people thought it would be.

The Trump Put

On Sunday, Treasury Secretary Scott Bessent said he is “not at all” concerned about the stock market despite its recent fluctuations in response to President Donald Trump’s tariff threats. Trump has wavered on imposing tariffs against Canada and Mexico, two of America’s closest trading partners, while also threatening steep tariffs on other allies, such as the EU. Additionally, he has enacted broad tariffs on aluminium and steel, with Bessent confirming that Trump’s “reciprocal” tariffs on other countries will kick in on April 2.

“I’m not worried about the markets. Looking at the long haul, if we implement sound tax policies, deregulate where necessary, and ensure energy security, the markets are poised to thrive.”

Despite stock market fluctuations raising concerns about potential long-term economic troubles, Bessent did not dismiss the possibility of a recession but said there were no reasons the U.S. must enter one. Trump, too, has refrained from ruling out the chance of a recession, acknowledging that his policies could cause Americans some economic discomfort.

The run-up to the inauguration and accompanying euphoria and animal spirits across markets have materialised into a period of pain. Trump has commonly been viewed as a pro-growth president, but his approach comes with high variance. Markets priced in growth expectations before his inauguration, driven by bullish projections across various sectors like crypto and energy. While asset prices and the 10-year yield rose, underlying economic indicators weakened, such as the labour market. Ultimately, the so-called “Trump bump” was more about sentiment than fundamental improvements.

Is a Fed Put on the Horizon?

The Federal Reserve finds itself in a tight spot. They’ll want to respond to a weakening economy, but rising inflation expectations (which can be a self-fulfilling prophecy) and growing political uncertainty complicate matters.

On the latter point, the Fed must deal with a new administration that is experiencing radical change. Still, it must retain its apolitical stance, which protects its autonomy in setting interest rates.

Under a different administration, the Fed might have had more flexibility to consider an insurance cut—not in March, but possibly by late H1 or early H2. However, the current environment brings the risk of cutting too soon, which could attract scrutiny from the government and emerging departments like DOGE. This situation leaves the Fed in a reactive position, where they are compelled to act late, especially when conditions begin to deteriorate noticeably.

On the inflation aspect, the University of Michigan’s inflation expectations have risen, but this survey produces very partisan results. It is not something we factor in as a team, but we acknowledge that it will still raise some attention within areas of economics, especially in regard to the expected effects of tariffs.

Elsewhere, inflation swaps and breakevens provide a more reliable measure, one which has seen expectations stay flat across the 2-year period and rise slightly on the 1-year.

As Nick Timiraos put it in an article for the WSJ this week, “Fed policymakers are alternately referred to as inflation-fighting ‘hawks’ or labour-market defending ‘doves.’ Right now, Powell looks more like a duck—calm on the surface while constantly paddling beneath murky waters.”

In our opinion, Chair Powell’s recent remarks on March 7th highlighted a cautious wait-and-see approach. His assessment of the February jobs report was notably optimistic; he chose to overlook the weaknesses in the Household survey. Instead, he focused on the fact that the unemployment rate has remained stable in the 3.9-4.2% range for several months. Additionally, he downplayed the decline in consumer sentiment, pointing out the ongoing disconnect between sentiment and spending observed over the past few years.

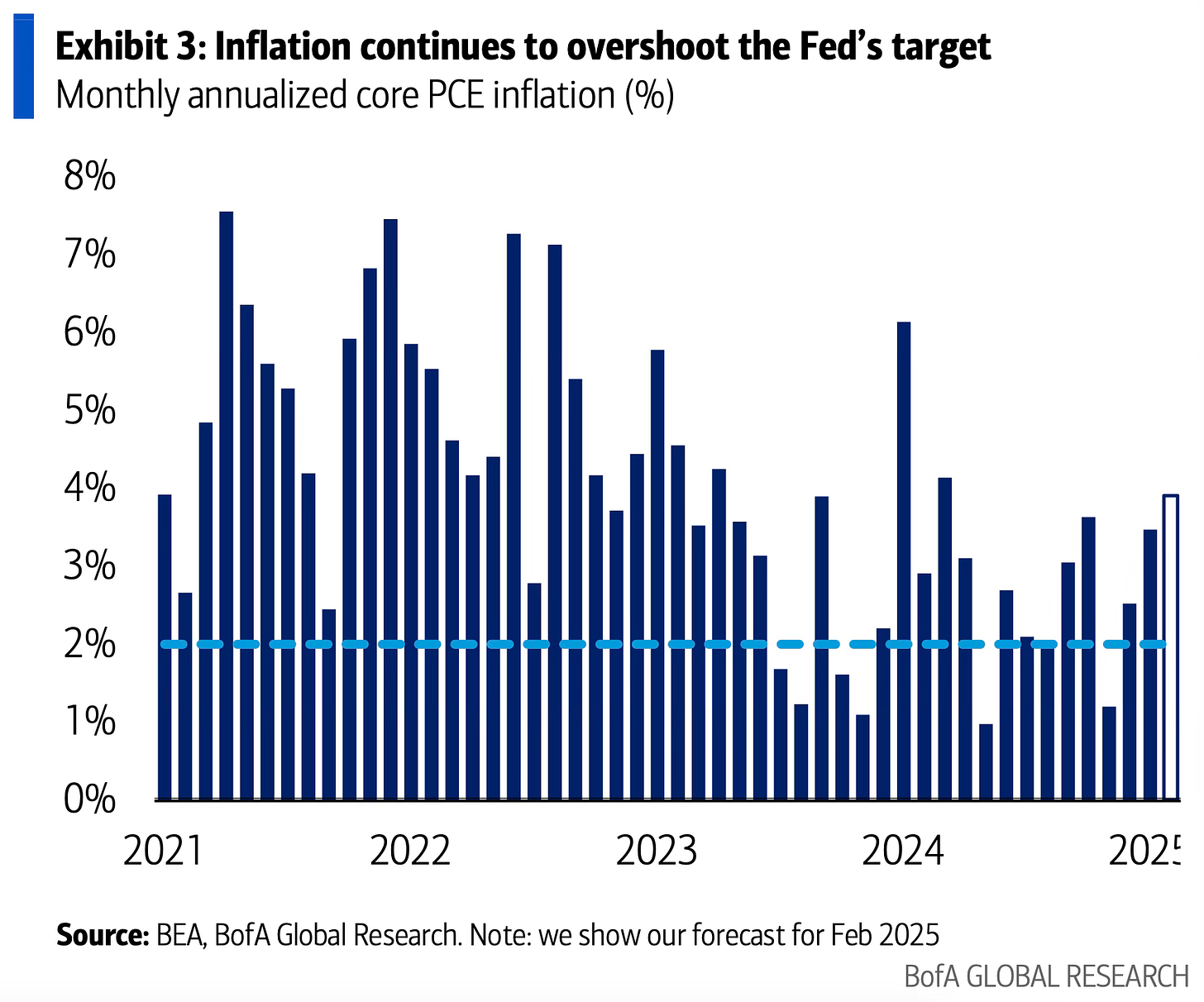

So, what have we learned since then? The Fed’s preferred inflation measure, core PCE, is expected to show a robust increase of about 0.3%, with a chance it could round up to 0.4%. Furthermore, February’s data likely didn’t capture much, if any, impact from the China tariffs. Therefore, unless retail sales come in significantly lower on Monday, it’s unlikely that Powell will adopt a more dovish tone.

That leads us to an FOMC preview.

All About Uncertainty

We expect the upcoming press conference to centre on the Fed’s response to ongoing policy uncertainty.