Why Is VF Corp In Such A Pickle?

The owner of The North Face, Supreme and other brands has seen a 77% share price fall over the past five years.

VF Corp is name that you might not come across that often. Technically the business has been around since 1899 as Vanity Fair Mills, before turning into VF Corp back in 1969.

It markets itself as the world’s leading portfolio of active-lifestyle brands, with 12 major ones currently being marketed. These are shown below:

Given that all of us likely have an least one item from one of these brands sitting in our closet, it might surprise some to know that despite the strong line up, the business has been struggling. With the stock down 36% over the past year alone, something clearly isn’t adding up.

Problems to contend with

Taking a look into the earnings reports over the past year highlights the problems that have been with the business for a while now.

Supply chain issues

VFC has faced ongoing supply chain challenges for several reasons. Firstly, the company's vast portfolio of brands necessitates complex and diversified supply networks. It’s not simply operating in one segment of the marketplace.

Moreover, the company sources materials and manufactures products in numerous countries, subjecting it to variety of uncertainties. When you look at the fall in the share price from 2019 onwards, you have to factor in the Covid-19 shutdowns, tensions with China, the Russia/Ukraine conflict and more.

From our perspective, another big factor is the rapid changes in consumer preferences and the ever-evolving trends require VFC to frequently adjust production and distribution, which can strain its supply chain.

Brand relevancy

As anyone that has had exposure to fashion brands knows, staying relevant over a long period of time is very hard. Unless you have a genuinely iconic brand, nothing is guaranteed. In fact, even those with some of the most recognisable fashion houses globally (LMVH) are struggling right now.

Take a quick look at the latest quarterly earnings report from VFC, split at brand level:

Consumer demand can clearly be seen here. The North Face continues to grow (over 10 quarters of consecutive double digit growth). Yet Vans is clearly struggling as a brand, as is Dickies.

The aim is that this should balance out at a group level, but this isn’t the case for VFC in the recent past.

Consumer spending

We’d argue that even though the brands included aren’t luxury by definition, they aren’t staples. This means that when consumers feel the pinch due to difficult economic circumstances, they are going to cut back on non-essential spending on these brands.

For example, do customers really feel the need to pay extra for a T-shirt from a brand just because it is in collaboration with Supreme?

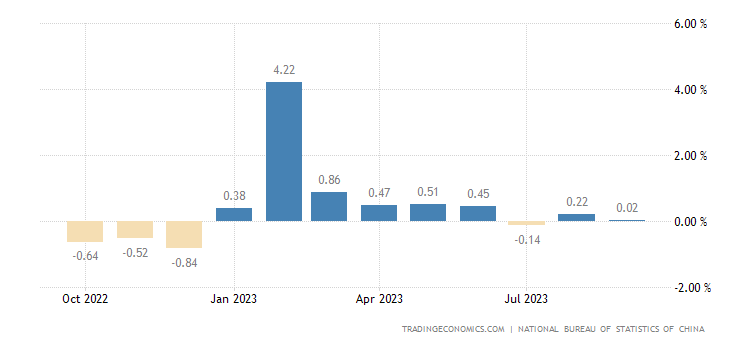

Retail sales in key markets has been pretty flat for most of this year. Below shows Chinese retail sales month-on-month. Apart from the outlier in February, it’s clear the Chinese consumer has been more cautious in 2023.

For the rest of this article, we’ll run through:

Why buying Supreme in 2020 was a mistake

If the stock is now undervalued

Investing ideas in this space

Buying Supreme in 2020

The announcement to purchase Supreme back in late 2020 for $2.1bn was seen as a great move by VFC. The brand had a cult like following, compounding by ultra-hard to get weekly drops, iconic collabs and validation by celebs.