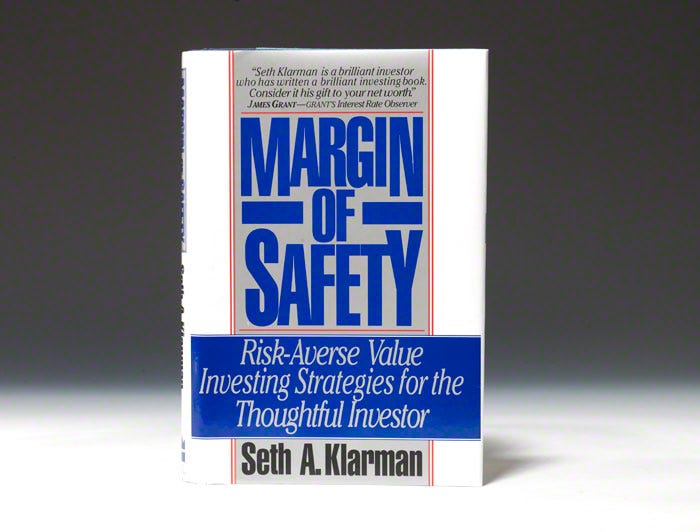

Why This Investing Book Costs $1,900

The holy grail of value investing.

“Margin of Safety” is considered one of the greatest investing books ever written. It is rumoured even to hold a place on Warren Buffett’s desk. Unfortunately, to get your hands on a copy of this book would cost you about $1,900.

The investment book emphasises the importance of risk management. The author, billionaire and uber-successful investor Seth Klarman, discusses the significance of having a margin of safety to protect against uncertainty. He covers various aspects of value investing, providing insights into his approach to successful long-term investing.

Here are the 12 takeaways from “Margin of Safety” by Seth Klarman:

1 - Margin of Safety:

Klarman's concept of a margin of safety involves buying assets at a price significantly below their intrinsic value. This approach provides a financial cushion against unexpected events or market downturns and minimises the risk of permanent capital loss. It allows investors to have a margin for error in their estimates and judgments.

2 - Value Investing:

Value investing, as advocated by Klarman, goes beyond simply buying cheap stocks. It involves meticulously analysing a company's fundamentals, including its balance sheet, income statement, and cash flow. Investors using this strategy seek stocks or assets that the market has undervalued, aiming to profit when the market eventually recognises their true worth.

3 - Market Inefficiencies:

Klarman argues that markets are not always rational or efficient. Inefficiencies arise due to factors such as investor sentiment, behavioural biases, or incomplete information. Investors who carefully identify and exploit these inefficiencies can gain a competitive advantage, as they understand that market prices do not always accurately reflect underlying value.

4 - Contrarian Thinking:

Contrarian thinking involves going against the prevailing market sentiment. Klarman emphasises the importance of avoiding herd mentality, as following the crowd can lead to overvalued assets. Contrarians, instead, seek opportunities in assets that are temporarily out of favour, anticipating a correction as market sentiment shifts.

5 - Risk Management:

Risk management, in Klarman's philosophy, is a comprehensive process. It involves assessing financial risks and understanding the broader economic, political, and market risks. Klarman advises diversification, position sizing, and a thorough understanding of potential downside scenarios to protect against adverse events.

6 - Patience:

Patience is a cornerstone of Klarman's investment approach. Successful investing requires the discipline to withstand short-term market fluctuations. Patient investors are better positioned to allow their investments to reach their intrinsic value and are less likely to make impulsive decisions based on temporary market trends.

7 - Understanding Investments:

Klarman stresses the importance of a deep understanding of investments. This includes understanding the company's business model, competitive advantage, management quality, and industry dynamics. Such knowledge is fundamental for making informed investment decisions and avoiding investments based solely on superficial analysis.

8 - Financial Markets Realities:

Klarman acknowledges the inherent uncertainties and complexities of financial markets. This involves recognising that many factors, including economic indicators, geopolitical events, and behavioural psychology, can influence markets. Investors must accept and adapt to these realities rather than rely on overly simplistic models.

9 - Behavioural Economics:

Incorporating insights from behavioural economics, Klarman explores the psychological aspects of investing. He discusses how cognitive biases, such as overconfidence or fear of missing out, can impact decision-making. Awareness of these biases allows investors to make more rational and objective choices.

10 - Long-Term Perspective:

Klarman advocates for a long-term perspective, viewing investments as business ownership rather than mere pieces of paper. This approach aligns with the principles of value investing, emphasising the importance of enduring short-term market volatility to realise the intrinsic value of investments.

11 - Cash as an Option:

Holding cash is seen as an option in Klarman's strategy. Cash allows investors to take advantage of opportunities that may arise during market downturns. It also serves as a hedge against uncertainty, allowing investors to deploy capital when more attractive investment opportunities present themselves.

12 - Continuous Learning:

Klarman encourages investors to adopt a mindset of continuous learning. Markets evolve, and staying informed about economic trends, regulatory changes, and industry developments is crucial. This commitment to ongoing education enables investors to adapt to changing conditions and make more informed decisions over time.

Learn more about the author, Seth Klarman, here:

A quick reminder: Our prices for premium subscriptions will go up to £10/month from January (this only applies to new subscriptions, so if you are already a paying reader, you’ll stay on the same plan).

However, if you join now, you can benefit from the current plan of just £5/month forever (or £50/year). To make the offer even sweeter, we’re offering a 14-day free trial as well. It wouldn’t be fair to ask you to sign up without letting you see what value we offer first.