Winter Rally Expectations Run Cold

A weekly look at what matters and how to trade it. (November 24th)

US equities bent again last week but haven’t fully broken. A Friday rebound pared earlier damage after the S&P 500 briefly sliced below its 100-day moving average. The fulcrum was Thursday’s air-pocket: a broad, catalyst-light selloff led by AI bellwethers that knocked momentum off its axis. Tech lagged as a group. Macro set the tone alongside megacap tape-action, and it wasn’t friendly at midweek.

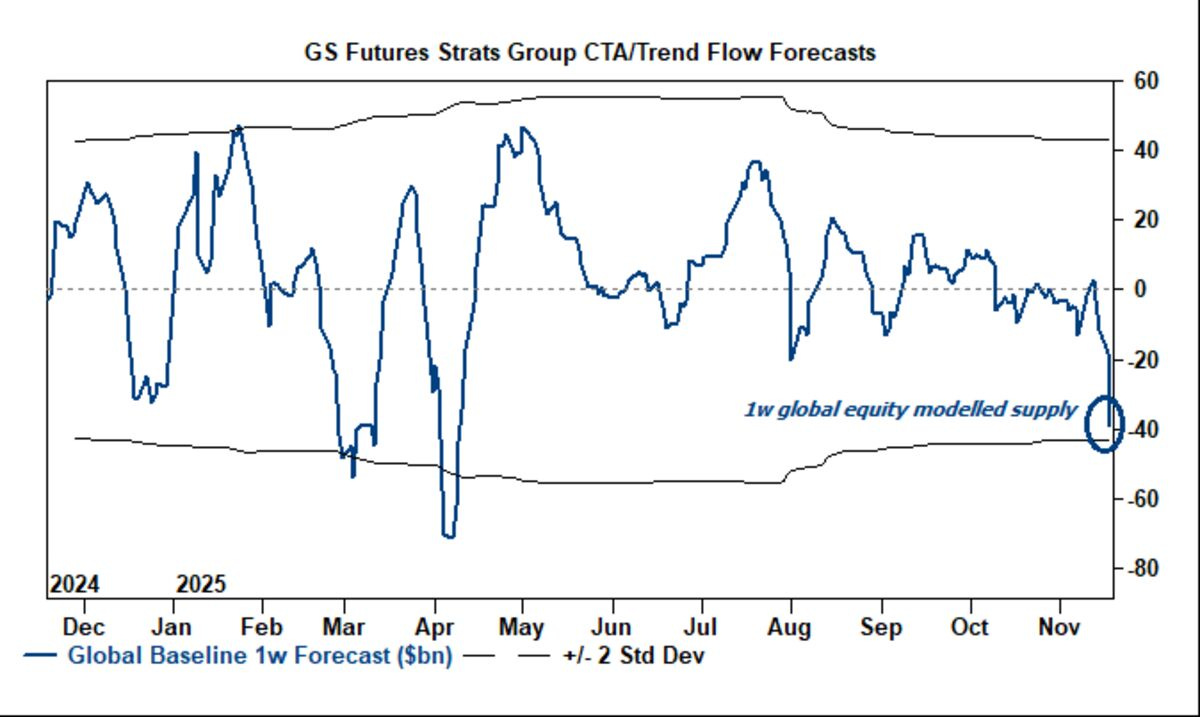

Positioning now matters as much as fundamentals. Goldman’s desk flags negative momentum and sizable prospective CTA supply if price weakens further.

S&P 500 -2.0%, Dow Jones -1.9%, Nasdaq 100 -3.1%

Outperformers: Communication Services (+3.0%), Health Care (+1.8%), Consumer Staples (+0.8%)

Underperformers: Information Technology (-4.7%), Consumer Discretionary (-3.3%), Energy (-3.1%)

Thursday delivered the sharpest intraday flip since April. Stocks opened strong on Nvidia’s print, then reversed hard: the S&P 500 swung 3.6% peak-to-trough and closed beneath its 100-DMA for the first time since February. Narratives multiplied. Questions on AI monetisation velocity, a firmer jobs beat trimming cut odds, and bitcoin sliding as a risk proxy. Nomura’s McElligott pointed to leverage across equities and crypto amplifying the air-pocket. The takeaway is simpler than the theories. Fragile momentum plus crowded longs equals a fast tape.

The world’s largest company, NVDA, cleared a high bar on outlook (Blackwell chips still marching), but shares faded 3.2% from early strength as the market sold strength in AI leadership. Street takes stayed constructive on revenue run rate and margins (4Q revenue guide $63.7b–$66.3b; adj. GM ~75%), yet “good news, sold” was what mattered for factor exposure.

On the opposite side of equity markets, Walmart raised the full-year bar and rallied 6.5%, value signposts, traffic resilience, and a measured tone on the consumer.

Eli Lilly crossed the $1 trillion mark as GLP-1 leadership compounded. Our thematic piece from July on GLP-1s, including the long basket (hint, Eli Lilly was included), can be read here.

In a week where defensives outperformed, the milestone reinforced why health care sits atop factor rotations when growth jitters rise.

Crypto was its own volatility engine. Bitcoin is tracking its worst month since 2022, and spillovers into high-beta equities are getting harder to ignore. If forced selling persists, it will act as a pro-cyclical volatility source for the broader risk complex.

As far as data and Fedspeak, the September payrolls release finally landed and beat at 119k vs 53k expected, the first upside since July. Rates markets promptly priced out a December cut, with OIS slipping to roughly 16bps of easing by Friday morning. Then, New York Fed’s Williams reopened the door, saying near-term cuts remain plausible, and equities bounced into the close. Net-net, the data revived the “good news is bad” loop for cuts, but the Fed’s guidance remains sufficiently elastic to keep risk from locking into a one-way bet.

Treasuries rallied into week’s end as equities wobbled, with 10s roughly 7bps lower on balance. The belly led early, then the move broadened as cut odds whipsawed. In FX, the dollar’s recovery extended through midweek (EUR/USD briefly broke back below 1.1500) before a late fade on Williams’s comments. USD/JPY strength eased after a verbal warning from Japan’s finance minister checked the move.

The Economic Calendar

United Kingdom:

The UK budget on November 26th will be the key focus for investors in what seems to be the most anticipated UK Budget in decades. Gilt and sterling investors remain nervous due to uncertainty on fiscal policy. Rachel Reeves is likely to deliver a well-balanced budget that restores investor confidence and avoids political unrest. We wrote more about this in last week’s note.

United States:

Key US releases include September retail sales and food services on Tuesday and September durable goods data on Wednesday. Both were delayed by the recent government shutdown and were initially due in October.

The Treasury will auction $69 billion in two-year notes on Monday, $70 billion in five-year notes on Tuesday, and $44 billion in seven-year notes on Wednesday.

Thursday is closed for Thanksgiving.