6 Implications Of A US Debt-Ceiling Crisis On Financial Markets

We provide a rundown of how four major asset classes could react to pressure in coming weeks.

Fixed income: credit downgrades could hit US debt both in terms of price and also accepted collateral.

FX: safe havens such as the Swiss Franc could outperform, with a longer-term impact on the de-dollarization debate.

Stocks: a comparison to 2011 shows the extent of a short-term drawdown.

Gold: although not our base case, a black swan event could cause a clean break above $2,070.

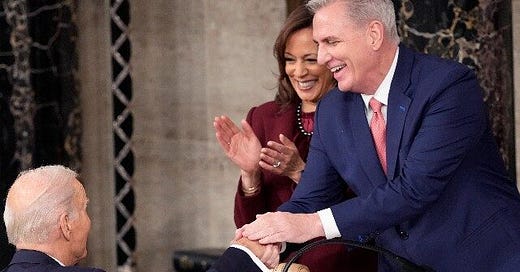

As early as 1st June, the US could reach the legal cap on the size of national debt, triggering a potential default. This isn’t the first time things are going down to the wire, with political posturing likely from both sides of the House. However, financial markets are likely to come under stress the closer we get to D-Day. With that in mind, we run over some of the implications that investors should be aware of.

The brief rundown

Historically, the debt ceiling has been either raised (to accommodate further borrowing), or suspended (allowing a temporary mismatch) when it has come close to being breached.

Regardless of who has been in power, this situation has never been easy to resolve. Traditionally, Democrats are much more at ease with raising the limit, seeing it as part of a functioning Government. Republicans are much more conservative in this regard, wanting to have a more balanced book.

The problem in recent years is that the debt ceiling has become a way for negotiating on other policies. In order to get a deal approved, concessions or repeals of other mandates are thrown in. This often can make discussions more time consuming and harder to agree to.

US Treasury Credit

One implication is the value of US Treasury Bills and other Government bonds in the wake of a default. If credit agencies issue downgrades to the level of US debt, then any issuer whose credit relies on US Gov backing would be at risk.

Initial thoughts go out to the likes of Fannie Mae / Freddie Mac but this could spread outside of just purely Gov-funded enterprises.

Use of Treasuries as Margin

Should concern spread regarding US debt and credit viability, we’d expect banks and other lenders to provide a haircut on what collateral rating gets assigned to UST’s.

For example, a hedge fund trading through the prime brokerage arm of a bank may find that overnight it has to post more cash collateral in order to make up for the shortfall in the haircut on UST’s that it was previously holding with the bank as margin.

This provides more than just an inconvenience for those involved.

Accelerated De-Dollarization

The debate around whether the US Dollar is losing it’s place as the global reserve currency isn’t a new one. The below chart was posted late year from an IMF study, showing a gradual decline in USD reserves. We personally don’t see it going anywhere, despite what others say about the Renminbi, Bitcoin or other potential options.

However, we do feel that in the medium-term, issues around the US debt-ceiling could accelerate nations to push for de-dollarization. In the sense of reducing exposure to the currency, it would be sensible if a nation feels that the political uncertainty associated with the fiscal discussions is becoming unpalatable.

Granted, this isn’t something that will happen overnight. But issues now could spell trouble down the line.

Pressure on equities

It’s hard to gauge the extent of any potential fall in the stock market based on the squabbles. However, we can look to the past to get a feel for what could be in store.

Below shows the movements in the S&P 500 back in 2011. We were in a similar situation at the start of August, at which point the market took a sharp move lower. A credit downgrade on 5th August pushed the market even lower.

This meant that there was a 17% drawdown in the space of just a couple of trading weeks.

Of note - this was resolved and the market bounced higher in October, highlighting how any issues again this time could provide an option for investors to buy a dip.

Gold could be an outperformer

Earlier this week, we outlined in detail our reasons behind having a slightly contrarian view on the gold price in coming months. We feel a rangebound price makes more sense fundamentally instead of a large break higher in the short-term.

With that being said, we can’t predict for a black swan event such as a debt-ceiling implosion at the start of June. If we did see things get messy, another implication would be a likely jump in the price of the precious metal.

If it managed to clear highs above $2,070 then momentum buying could further push the price clear of $2,100 and into unchartered territory.

Watch out for FX safe havens

The Japanese Yen has endured it’s own headaches over the past year with yield curve control. As such, the desire of many to buy the Yen as a safe haven has diminished somewhat.

However, the Swiss Franc has performed very well year-to-date. USD/CHF trade sub 0.9000, a level that anyone experienced in G10 FX will appreciate shows the strength of the Franc.

Issues over the debt ceiling (although not being a primary driver for G10 FX) could see inflows into the Franc in coming weeks. This would offer a way for FX traders to make a play on the event without having to step into the cross-asset space.

AlphaPicks is a reader-supported publication. We value all of our readers and cannot wait to continue to bring more insights in the future and continue to expand our work. Subscribing is a key way to support our growth to allow us to scale up with new initiatives.