Back On The Menu: Equity Diversification

YTD sector and style returns give us some interesting takeaways.

Sometimes retail investors can get carried away with holding large concentrated positions in just one or two stocks.

Back in 2020, if you just held Tesla shares, you killed it.

Over the past year, if you just held Nvidia shares, you killed it.

If you copied Roaring Kitty and YOLO’d GameStop shares and options over the past month, you probably killed it (?)

Yet cases where not being diversified and banking large profits as a result are fewer than you might think. Just take a look at wallstreetbets Reddit to get a clearer picture of peoples actual P/L from trying to actively trading GME or AMC (or even the bag holders).

We then read a good piece put out by the dark side of the force, aka Goldman Sachs, on the returns so far this year across the board, which makes for very interesting reading…

As a friendly reminder, you can become a premium subscriber with us for just £10 a month. This provides you full access to our weekly articles without a paywall, including our flagship Monday trade ideas and access to what we are buying and selling in our Global Asset Portfolio.

Takeaway 1: People Are Diversifying From Winners

To be clear, the MAG7 performance ranks as the second best bucket that GS included in their research. Yet the return isn’t as high as some might expect.

We feel this is in part reflecting investors taking profits from the MAG7 after the run up over 2023. After banking profit here, funds are then reallocated into different areas of the market that were previously ignored.

Examples included the Tokyo Stock Price Index (TOPIX) as well as European Banks.

Does this make sense? We think so. For example, capital tied up in a high-performing stock that now is potentially overvalued might miss out on lucrative opportunities elsewhere. By diversifying, investors can seize new investment opportunities in different sectors or asset classes that may offer better growth potential from this point forward.

Let’s also not forget that rebalancing a portfolio after a few stocks shoot higher forces diversification.

A significant rise in the value of one stock can skew the portfolio's asset allocation. For instance, if a particular stock grows disproportionately, it might exceed the investor's desired exposure to that asset or sector.

Takeaway 2: It’s Also A Rates Trade

Is this subheading just another excuse to bring out one of our favourite memes?

Well…yes and no.

When rates (during the pandemic) were so low, it led to increased equity market concentration by enabling cheap financing for large corporations, driving investment into growth stocks (particularly in tech/early AI), increasing valuations of mega-cap companies, and amplifying the effects of passive investment flows. These factors combined to create a market environment where a relatively small number of large companies dominated equity markets.

We don’t have time to run through all of these factors in detail, but consider one key one that relates to the average retail investor.

Low interest rates during the pandemic mad the Treasury and bond markets less attractive due to their lower returns. Therefore, investors, seeking higher yields, shifted their focus to equities, particularly growth stocks (Tesla was a classic example).

Growth stocks, typically in technology and other innovative sectors, promise higher future earnings, and low-interest rates make the present value of these future earnings more attractive. As a result, a significant amount of capital flowed into a relatively small number of high-growth companies, increasing their market cap and concentration within equity markets.

However, now that rates have been lifted, we’re starting to see the opposite occur. With a higher cost of capital, it’s really differentiating which companies are sound versus which ones have too much debt.

Further, if investors can pick up 5% in the bond market, so they become more risk averse on chasing highly valued tech stocks even higher. Rather, moving into sectors like US Utilities is a classic example that shows us that investors are becoming more prudent and more diversified in their portfolios.

Also, the negative return of non-profitable tech companies is really telling. With low interest rates, the low discount rates for valuation protected this stocks.

Higher rates increase the discount rate, which lowers the present value of future earnings and cash flows. This impacts the valuation of growth stocks, particularly those whose value is based on future earnings. Investors, therefore, become more critical of the growth prospects and current valuations of such stocks.

Takeaway 3: Energy & Financials Are Back

The gains from European Banks and US Energy sectors is very telling. These were shunned as value traps in the past, but coming into this year things have changed.

The sectors have become a lot more profitable. For banks, higher net interest income from higher rates has really helped. The volatility in global markets has further boosted income from these divisions.

At the start of the year, we wrote a piece entitled “why Barclays is a screaming value buy.“

We flagged up some key stats about the company, noting that:

Earnings per share ratio: 4.9 (vs theoretical fair value of 10)

Trailing earnings per share ratio: 4.3 (vs theoretical fair value of 10)

Trades at 0.4x book value (vs theoretical target of 1)

Dividend yield: 5.01% (vs FTSE 100 average 3.80%)

From these key metrics (particularly price to book), Barclays looks like a strong value purchase right now.

We bought the stock for our Global Asset Portfolio, with it up significantly since January.

Speaking of our portfolio…at the beginning of the year, we developed this portfolio to share with our Substack audience. Our team devotes numerous hours to researching and writing articles, as well as sharing our individual trade thoughts with you, the reader. Most of our weekly research posts focus on thematic ideas. For the month of May, we published our insights on copper and solar energy, and we have started to allocate capital to these industries.

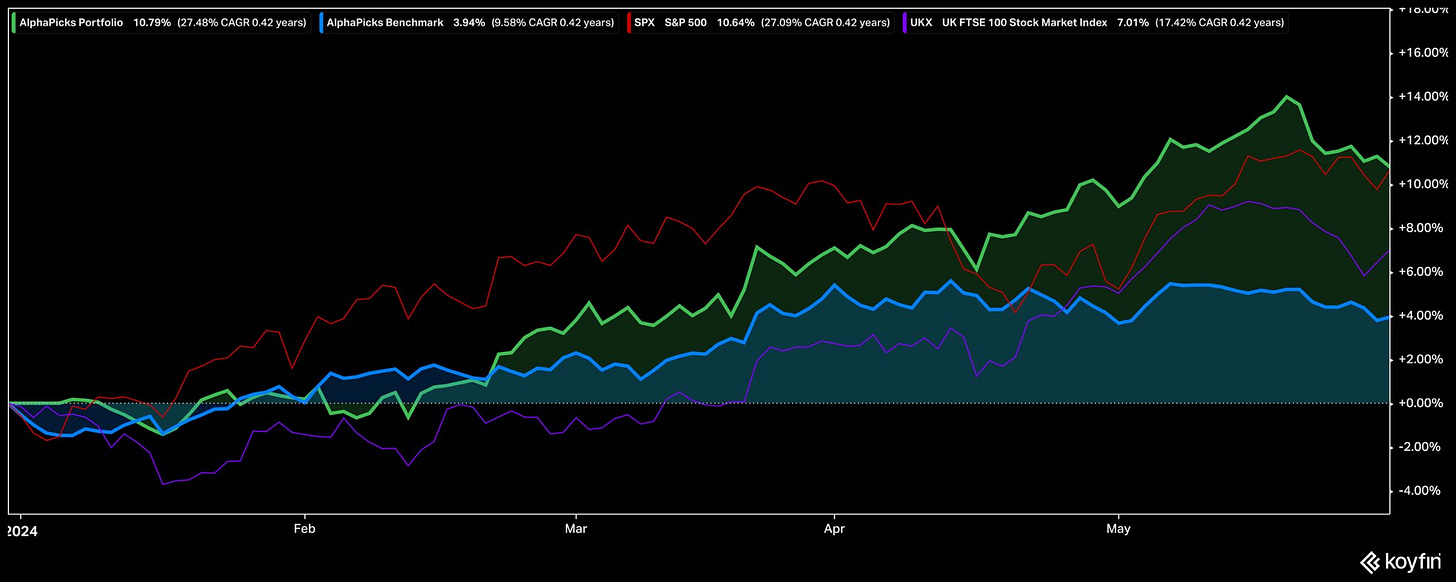

Our YTD performance of 10.74% (in green) is ahead of our benchmark, as well as beating the S&P 500.

To access our portfolio reviews and see what we are buying and selling, you can subscribe;

Anyway, back to the article. The US energy sector should have further legs to run given increased electric demand via AI, investors viewing it as an inflation hedge, continued supply constraints and more.

Let’s not forget about the dividends from banks and energy companies too. The yields available for the passive income make it very attractive for investors, again even more so now that interest rates are higher.