Fiscal Blowouts & Forward Guidance

What type of Christmas is in store for the bond market?

The U.S. bond market, currently fighting its strongest sell-off in more than a year, now enters a pivotal two-week period that could significantly influence its trajectory into year-end. Investors brace for potential implications stemming from key economic indicators and policy developments.

Market-moving events are coming quickly, and today’s Quarterly Treasury Refunding announcement (QRA) will signal the scale of debt sales and its forward guidance. Other data prints—PCE (Thursday) and monthly payroll figures (Friday)—will show whether the economy is cooling enough to justify further interest-rate cuts at next week’s FOMC meeting, the first since Powell started his monetary policy decline.

And then we have a presidential election next week, too…

Bond market risk will be elevated for the next few weeks. The MOVE index, a measurement of bond market volatility, has been rising over the past several weeks (see our article earlier this month for more on this).

There are two considerations today: 1) Fiscal Blowouts and 2) Forward Guidance.

Let’s start with the former.

Fiscal Blowouts

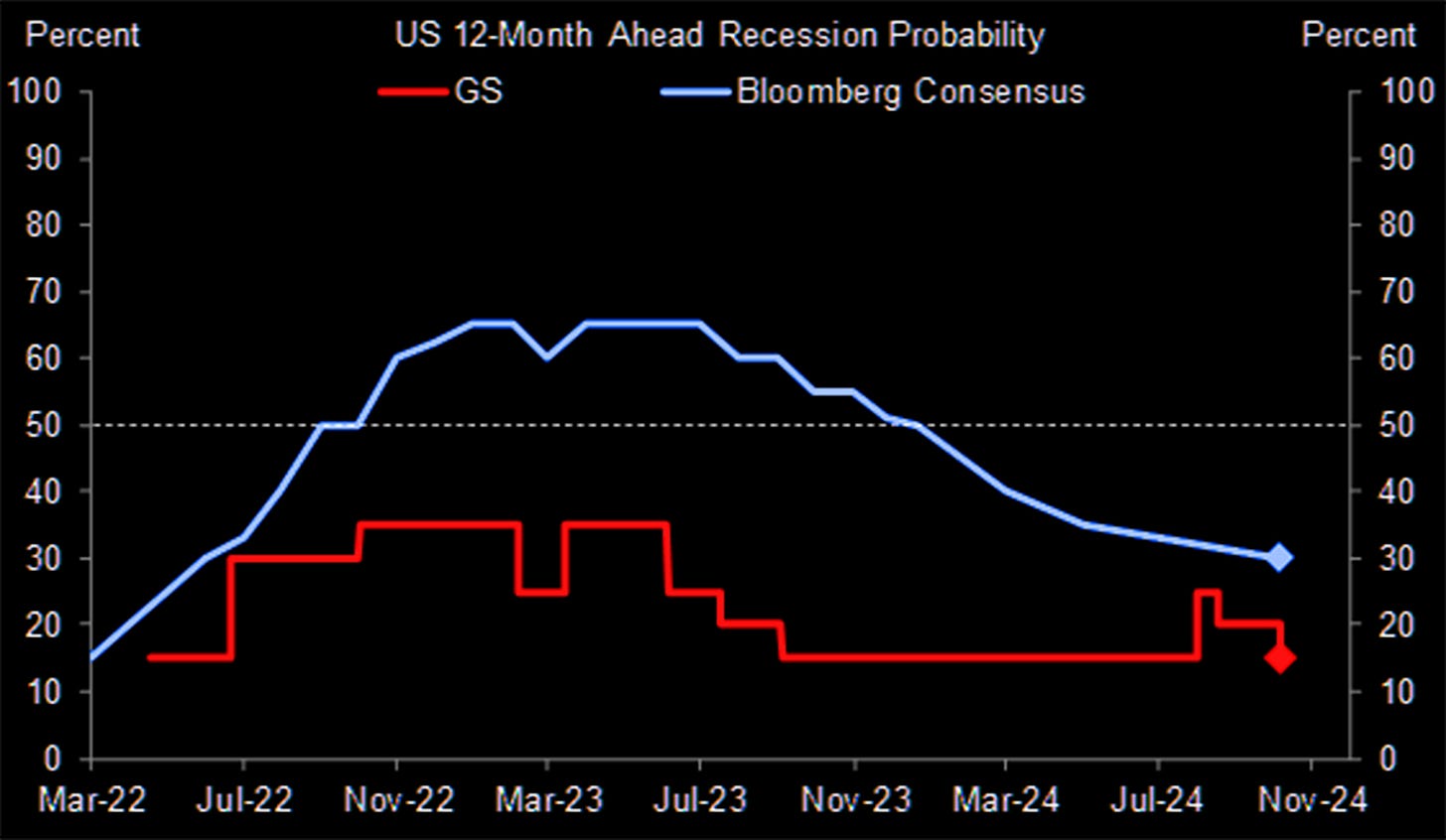

A stronger-than-expected economy is weighing on the rate-cut tailwind for bonds. The recent market selloff began in earnest at the start of this month following the release of a positive September jobs report. This development alleviated concerns about a potential recession in the United States, prompting investors to adjust their expectations regarding the Federal Reserve’s likely modifications to interest rates in the forthcoming months and years.

Markets are now expecting rates at the end of 2025 to be around 3.5%, but prior to September’s FOMC meeting were expecting an additional 75bps worth of cuts.

Goldman Sachs’s baseline scenario for higher inflation (dark blue line on the left-hand side of the chart below) sees rates settling above 4%. Assigning a 20% probability to this outcome feels like a lowball, in our opinion.

Investors are speculating that a victory for Trump will push yields higher in anticipation that his tax cuts and tariffs will fan inflation pressures and keep rates elevated. The budget gap will expand the most if Republicans sweep control of both the White House and Congress.

As probabilities of Trump’s electoral success increase, so do longer-term yields. His campaign proposals could potentially expand fiscal deficits by $7.5 trillion over the next decade, as per analysts.

Even if you are to take an agnostic view going into next week’s decision day, neither Trump nor Harris are making deficit reduction a central element of their campaigns. The cost of spending programs such as Medicare and Social Security will climb faster than federal revenues. That leaves the trajectory of U.S. borrowing only one path: higher.

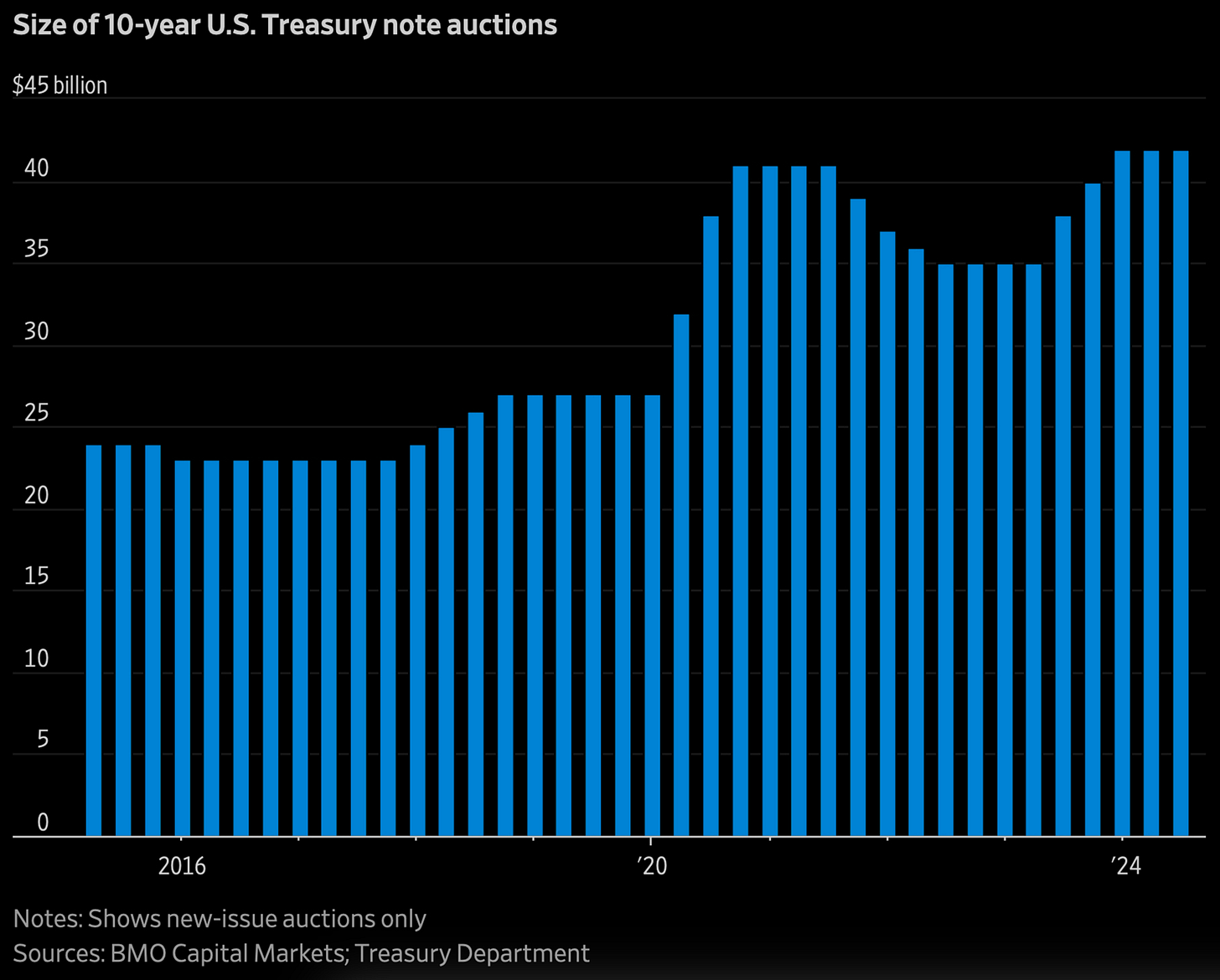

Increases in the size of longer-term debt sales seem inevitable at some point. That will be what markets are on watch for in today’s QRA.

Forward Guidance

On May 1st, the Treasury Department wrote this sentence in their statement:

“Based on current projected borrowing needs, Treasury does not anticipate needing to increase nominal coupon or FRN auction sizes for at least the next several quarters.”

The forward guidance provided by the Treasury regarding refunding announcements represents a relatively new approach. Should there be a modification to the guidance that results in the omission of the current language, it could potentially unsettle the market.

For now, we can expect that it’s keeping the size of its debt auctions steady in the upcoming quarter, which mitigates any potential short-term supply pressures (a much-needed ease for bond markets). However, there remains a chance that they could hint at increases further into 2025 through a change of language in their guidance.

Some U.S. debt auctions, including those for 10-year notes, have already reached record sizes.

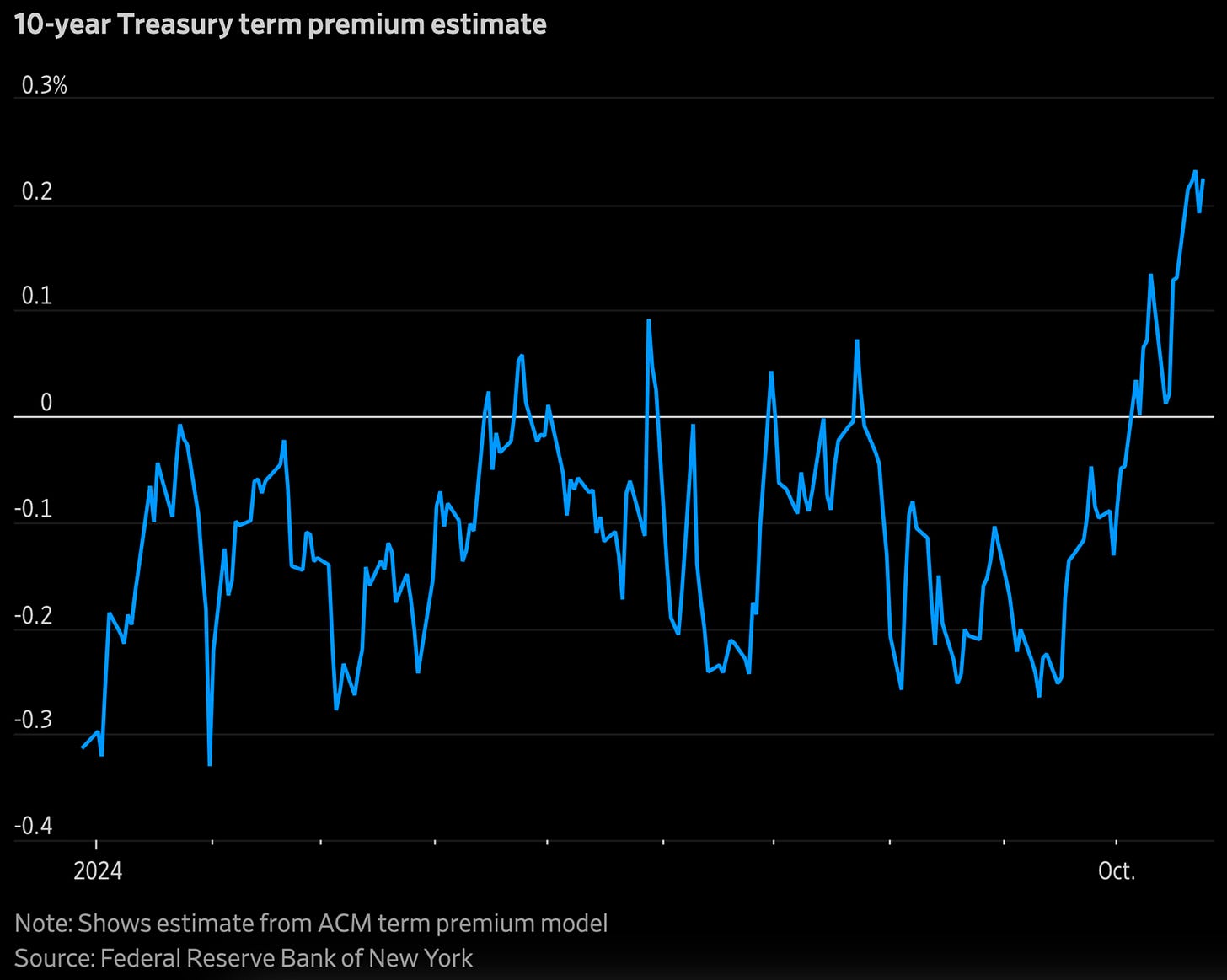

When investors are concerned regarding the supply of bonds, longer-term Treasury yields typically experience a more significant increase than shorter-term yields because they are less tethered to the near-term outlook for interest rates set by the Fed.

This situation often leads to an elevation in estimates of the term premium, which represents the portion of Treasury yields that accounts for factors beyond the anticipated trajectory of interest rates, including the supply dynamics of Treasuries.

One dynamic expected in the coming months that may benefit the bond market is a potential deceleration or cessation of the Federal Reserve’s quantitative tightening (QT) programme1. Expectations for when this may start have been pushed back to mid-2025.

For now, reserves are abundant. The Reserve Demand Elasticity, or RDE, tool shows that reserve shifts currently have little impact on the fed-funds rate, meaning the Fed can comfortably continue QT into 2025, barring an unexpected economic or financial shock. (h/t Conks for this infographic).

So What?

The premium to hedge a selloff in the long-end of the curve remains elevated relative to shorter-dated tenors and is close to the most expensive this year in terms of the price of long-bond puts versus calls.

It’s a tough-looking landscape for the bond market. Fiscal deficit blowouts would be risky for bonds in any circumstances. But it looks doubly explosive at a time of expanding auctions.

In an interview last week, Paul Tudor Jones announced that he has dumped all US fixed-income products and is shorting long-dated Treasuries, favouring Bitcoin, gold and commodities instead. Perhaps one takeaway from this is that it takes an experienced practitioner to know what a herd of experienced practitioners might do in these circumstances.

This was a freebie post for all subscribers, but if you want to become a premium subscriber and access every article, you can manage your account here.

We hope you enjoyed today’s thoughts. Likes and comments are always warmly welcomed and appreciated.

AlphaPicks

QT consists of allowing a portion of Treasuries to mature from the central bank’s balance sheet without replacement and forces the Treasury to sell more debt to the public—more supply pressure.

Quantitative easing (QE) is a monetary policy strategy used by central banks like the Federal Reserve. With QE, a central bank purchases securities in an attempt to reduce interest rates, increase the supply of money and drive more lending to consumers and businesses.

Chart-packed. The way forward.