Part of the content that we put out at AP is designed to be educational. Yet we feel there’s also an area where things can be both educational and interesting. The bulk of our readership base is related to global markets in some form, but at varying degrees of expertise.

Based on several requests, we recently starting a primer series for a variety of different financial instruments, based on our experience of trading the products. We’ll point out the common mistakes as well as the little wrinkles to make note of, all of which we hope will make users more informed and close the knowledge gap in areas where information isn’t that readily available.

Our last GPS on FX Options was one of our most liked articles this year, so based on that we’re sticking to FX but looking at spot and forward contracts.

FX Spot is the term used to describe a trade buying one currency and selling another. Technically, it is a contract between the user and the counterparty (i.e a bank) to exchange a specified amount of one currency for another at the spot rate agreed.

A FX Forward is an agreement to exchange currencies at a predetermined rate (the "forward rate") on a future date, beyond the standard spot settlement period. Usually spot trades are done on a T+2 settlement, with forwards in theory being able to go out several years.

Spot and forward can be great ways to express a view in the market, but equally can be used as hedging tools.

As a disclaimer, FX Forwards are complex instruments that have the potential for high losses and should only be traded by experienced investors with a full understanding of the risks involved. The prime does not constitute advice or any recommendations to enter into a specific FX trade.

FX Spot Basics

Unlike a stock that’s traded on a public exchange, there’s no central market for an FX pair. Rather, market makers from leading banks and brokers put out their own prices for each currency pair.

Given the rise in recent years of eFX (electronic FX), the price arbitrage between different providers is minimal, especially when we’re talking about G10 major currency pairs (for the purpose of this primer we’ll be referring to GBP/USD). The bid is where an investor can sell the base currency (i.e GBP) and the offer is where you can buy the base at.

Below you can see where many market makers are quoting on GBP/USD, and how the pricing is within a couple of pips:

This means that for most retail and institutional investors, it doesn’t matter where you go to book your FX spot trades. The spread to market should be very tight, and although you might not be able to access the interbank rate shown above, most can trade within a few pips of it.

The provider makes money from adding a small spread on top of what the market price is. Even with just a couple of pips, the high frequency nature of FX trades means that this can amount to a large source of revenue over a period of time.

Executing FX Spot

Like most asset classes, FX can be traded either on leverage or without. In our experience, there’s a clear difference when weighing up which to do.

If an investor has good liquidity ($10m+) to allocate to this asset class, then positions can be taken on without leverage. The advantage of executing this way is that the investor can take delivery of the underlying currency and have no risk of being margin called or forced out of the position prematurely. Further, unleveraged FX spot can be used effectively as an overlay into other trades. For example, an investor could be disgruntled by the UK equity prospects for the coming year, as well as thinking that GBP depreciates against USD over the next 12 months.

Therefore, he could sell GBP at spot, buy USD and then take delivery of the USD and invest in US equities. This then becomes a dual-play, ideally gaining from a fall in GBP/USD and gaining from US equity growth. This position could be hedged out from FX risk via an FX forward, but that’s beyond the scope of what we want to cover in the primer.

Alternatively, FX spot can be traded on leverage and this is the most popular option from the retail crowd. However, executing on leverage often comes without knowledge of the size of the notional trade being taken on. Let’s explain.

Let’s assume you have £10k in a trading account, and can access 10:1 leverage on FX. This means that you could have a total notional position size of £100k. Now let’s say that GBP/USD moves 5% against you. The loss is calculated on the notional amount, so £5k. Yet due to the leverage, you’re actually down 50% from your account (£5k relative to £10k).

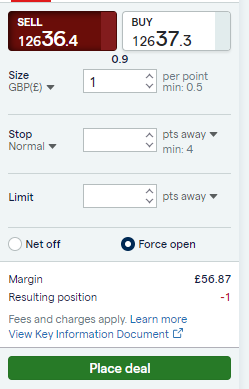

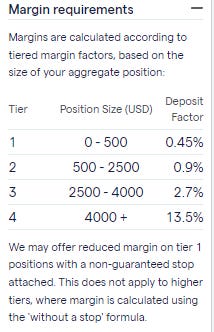

This isn’t always clear when trading with brokers, mainly because these days you often trade with a size per point / size per pip. In that case, you might see a deal ticket that looks like this:

There are a few things to note here. The size (we have put £1) is the per point monetary movement. The stop loss and limit / take profit levels can also be set by the pip/point.

The initial margin figure can be seen as £56.87. We know from the margin requirements (see below) that this has a deposit factor of 0.45%. This all makes sense, as 56.87 / 0.45% = 12637.

But what about our important notional size? Well this is £12,636. You can work this out by doing £1 x 12636. Or you can figure that if £56.87 is 0.45% of the position size, then 100% is £12,636.

The position sizing on leverage is important, not only to manage your initial margin requirements but also to factor in where you might get margin called.

How To Trade At Spot

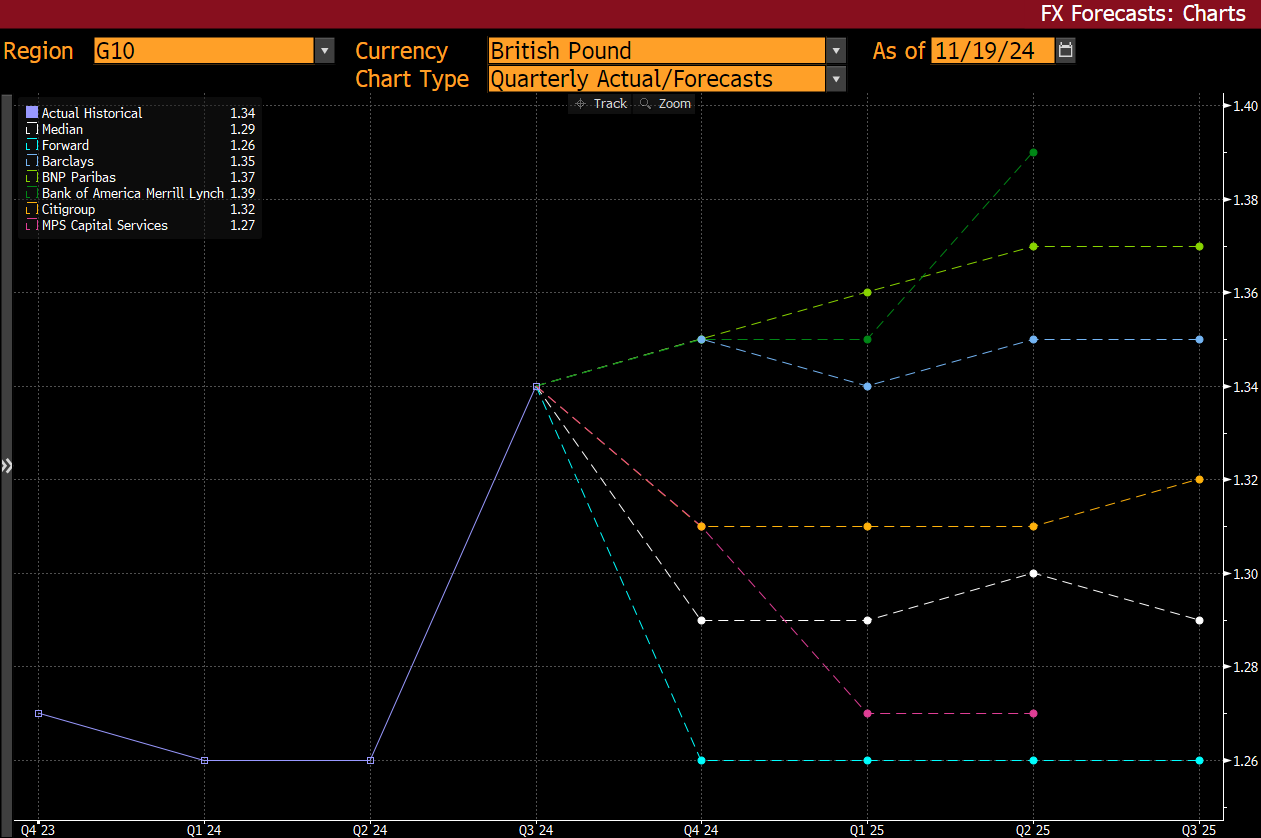

There’s a good reason why many say that trading FX spot is the hardest out of various asset classes. To illustrate this, we’ve pulled the forecasts for several major contributors for GBP/USD over the coming year:

You’ll note that BAML are looking for 1.39, while MPS are down at 1.27. There’s a huge range here, reflecting the divergence of views on the Street for the coming year.

What makes FX hard to trade isn’t the execution or the jargon or the pricing, but rather having an accurate macro view of the world. An FX trader is essentially trying to compute the state of one economy (i.e the UK) against the state of another (the US). And not even the current state, but the future state and how each compares. This encompasses politics, economics, monetary policy, natural disasters and everything in between.

We tend to find that trading FX at spot is best served in two ways. The first is intraday, based a lot more on a technical basis and looking for a short-term move. This is suited more for leveraged trading, as the cost of holding the position is small.

The second is with a one-week to three-month time horizon. This is suited more for investors that trade unleveraged and want to take on a view that can encompass future central bank meetings, data points etc. This also allows a wider stop/take profit level.

We see little value in trading FX spot with a horizon greater than three months. It’s too hard to be correct on a view, and even if one wants to express it, it’s much more suited to using Options instead.

FX Forward Basics

Now let’s move onto forwards. A forward can be thought of as a spot trade with a longer settlement period. Yet there’s a key difference in the way these are priced.

The difference is known as the forward points. This is shown below for GBP/USD:

On the far left you have the tenor in yellow. This has SP - spot tenor in blue, which is what someone would trade if they wanted it at spot. Vertically going down you have tenors like 2W (two weeks), 3M (three months), 2Y (two years) etc.

On the next column you have the actual calendar date that the tenor corresponds to. It has to be a working day, so sometimes it reverts to the nearest Friday for settlement.

Then you have the Pts bid / Pts ask. This is the size of the adjustment needed to the market bid/ask to make up the forward. These can be either positive or negative. Positive and you add them to the spot rate, negative and you take them off.

The Fwds bid / Fwds ask is simply the spot added to the points, giving you the outright forward price for buyers/sellers.

The BIG concept to understand on forward pricing is that it does not reflect where the market expects GBP/USD to be at that point of time in the future. Put another way, the 1Y forward price of 1.2611/14 is not a forecast of where the pair will be in a years time.

Rather, the forward points reflect the swap rates of both currencies for the particular tenor. For example, the 1Y GBP/USD forward rate takes into account the GBP 1Y swap rate and the USD 1Y swap rate. The differential then is accounted for as to if the forward rate is above or below the spot rate.

If the base currency has a higher swap rate than the alternate currency, the forward price will be lower than the spot. This reflects the fact that holding the currency with the higher interest rate will earn more interest over the period, so the forward rate needs to be adjusted to factor this in.

With GBP/USD, you can see that the swap rates across different time periods are actually very similar. It’s actually quite rare to have such a minimal difference over longer tenors. For example, in the 1Y tenor, you only have to adjust by 20 pips on the bid to get the forward price.

Trading Forwards

Based on the above, you’ll have probably figured out that trading FX forwards isn’t actually that much about FX, but rather short-term interest rate movements. That’s why these trading desks (STIRT) within major banks mostly sit in the broader FX or FICC teams.

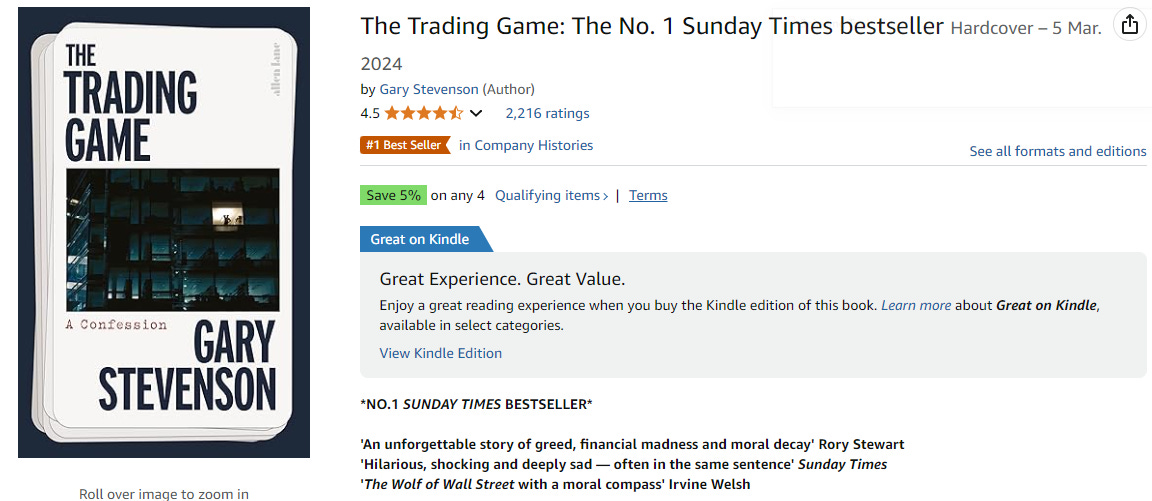

If you want to read an entertaining book about a STIR trader, the below release from earlier this year from Gary Stevenson is worth a holiday read (but take some of his statements around his P/L with a heavy dose of salt…):

Even though the forward points are calculated exactly from the swap rates, the actual swap prices are traded based on a variety of factors, including speculation! If we get some poor data out of the UK, short term Gilt yields, swap rates etc are likely to fall.

So trading an FX forward is partly an expression of trading the differential between two countries interest rate expectations.

That being said, forwards can still be of use to someone who is wanting to speculate on movements in the spot market. For example, for those trading spot on leverage, these positions have to be rolled, which costs. Instead, buying a forward means that there’s flexibility in holding that position for longer than two days. There’s no additional cost of keeping it live/open, as you’ve already priced in the cost of holding the trade via the forward points adjustment at the beginning.

Another way of using forwards is to benefit from leverage. For some, trading at spot on leverage isn’t possible, or isn’t approved on their investment mandate. With a forward, you often only need a small amount of initial margin (2-5%). This can then get you exposure to a larger notional on the forward, which only needs to be settled when the forward ends. You can close out the trade ahead of settlement, meaning only the profit/loss changes hands.

Finally, forwards can be used as an effective hedging tool both for FX positions and cross-asset needs. For example, let’s say that we sold GBP at spot, bought USD and bought Tesla shares. However, I might only want to take on the Tesla risk, not the currency. Therefore, I could sell USD forward for a year to hedge out the GBP/USD price movement.

A side note on this - forward contracts can be rolled, so if I wanted to keep my Tesla shares for longer I could do.

The same principle applies if I’m long GBP/USD just at spot, but am running a profitable position into a central bank meeting, data release or other key event. There are many ways of hedging my spot trade, including using options, but forwards can also be used (i.e in this case selling GBP forward) to eliminate our FX risk for that period.

Primer Summary

FX is a hard asset class to trade profitably over a period of time. Yet being able to understand the basics around the key products, namely spot forward and Options is a great start to avoid making mistakes. Further, understanding when and why to pick a certain product to express a view is key, given the different risk/return profiles.

We hope you’ve enjoyed this Primer (linked to our FXO piece). Please like, share and feel free to comment below.

AlphaPicks

Good Primer and thank you.

I respectfully express my opinion that it provided fewer insights compared to the previous primer, where the technical aspects were presented in a more comprehensive manner.

In my view, this primer remained overly simplistic and lacked depth.

I'll be keen to read those Primers coming!