Meet The Man Who Has Returned 6,000% Over The Past 30 Years

A disciplined approach and long-term focus helped Rochon achieve an honourable status in the investment world.

François Rochon is one of the best quality investors in the world. Over the last 30 years, he returned more than 6,000% to shareholders (15.7% per year). Here is his story.

François Rochon

François Rochon is a Canadian investor, author, and portfolio manager known for his expertise in value investing. He is the founder and portfolio manager of Giverny Capital, a Montreal-based investment management firm.

Rochon is highly regarded in the investment community for his disciplined investment approach and long-term perspective.

Rochon began his career in finance in the 1980s, working in various roles in the investment industry. In 1993, he founded Giverny Capital, which takes its name from the village of Giverny in France, where renowned painter Claude Monet lived and worked. The name reflects Rochon's admiration for Monet's dedication and long-term vision, which he applies to his investment philosophy.

As a value investor, Rochon focuses on finding high-quality companies with durable competitive advantages that are trading at attractive prices. In addition, he seeks to invest in businesses with strong management teams, solid balance sheets, and the ability to generate consistent cash flows over the long term. He is known for his patient and disciplined approach, often holding stocks for many years.

François Rochon has been recognised for his investment performance and insights. Barron's named him one of the "World's Best CEO Investors" in 2012, and he has been featured in various financial media outlets, including CNBC, Bloomberg, and The Wall Street Journal. He has also authored "The Little Book of Value Investing in Canada," where he shares his investment philosophy and principles.

Rochon is known for his humility and emphasis on continuous learning. He attributes his success to his passion for investing, his focus on the long term, and his ability to block out short-term market noise. He advocates for individual investors to have a clear investment strategy, do thorough research, and stay true to their principles.

His insights and success have made him a sought-after voice in the finance industry.

How to invest like Rochon

Great businesses have financial strength, a great business model, and skilled management. But, to be investable, they need to be selling cheaply in the market.

“We choose companies that have (sustainable) high margins and high returns on equity, good long-term prospects and are managed by brilliant, honest, dedicated and altruistic people. Once a company has been selected for its exceptional qualities, a realistic valuation of its intrinsic value has to be grossly assessed.” - François Rochon

Rochon looks for businesses which meet the criteria above. The rationale is that a wonderful business in and of itself is great, but pairing it with financial strength and a gifted management team can boost its performance over time.

Concentrating on owner’s earnings, not stock price movements.

“We do not evaluate the quality of an investment by the short-term fluctuations in its stock price. Our wiring is such that we consider ourselves owners of the companies in which we invest. Consequently, we study the growth in earnings of our companies and their long-term outlook.” - François Rochon

He does not include the change in valuation as a further return driver because, over the very long run, valuation plays a smaller role in stock returns. To address this, Rochon tries to buy stocks at low prices so that any change in valuation (i.e. change in the P/E ratio) of a stock he owns contributes more upside than downside.

Important psychological traits for successful investors to possess are patience, humility and rationality.

“There can be quite some time before the market recognises the true value of our companies. But if we’re right on the business, we will eventually be right on the stock.” - François Rochon

Rochon explains that in investing, patience in waiting for opportunities as well as waiting for the market to value investments fully is an important quality to have.

Rule Of Three

Below is an excerpt from the 2010 Giverny Capital Annual Report

“In conjunction with our investment philosophy, I've added a stock market rule that I called: The Rule of Three. This three-part rule comes from historical observations: it is not a scientific process that has come to its enunciation but an empirical one.”

One year out of three, the stock market will go down at least 10%.

One stock out of three that we buy will be a disappointment.

One year out of three, we will underperform the index

Giverny Capital

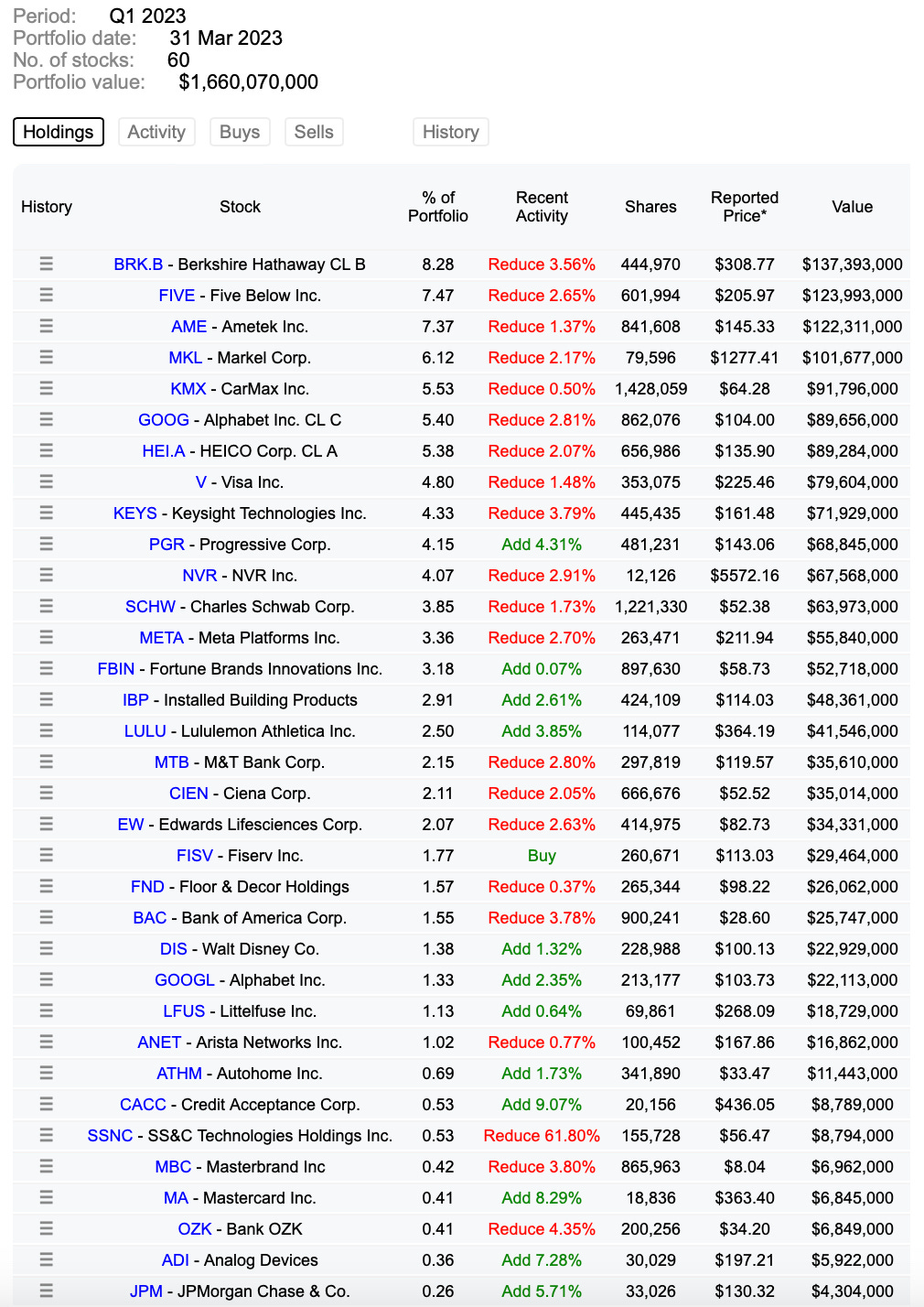

Here is a breakdown of Giverny Capital’s most significant holdings.

A complete list of their holdings can be found here.

If you enjoyed this insight into François Rochon and Giverny Capital, please feel free to like this post and share it with others. It helps us more than you know.