Ken Griffin - An Example For Excellence In Trading, Investing And Business

There are several takeaways from the career of Ken Griffin. One of the most important? You're never too young to start.

Ken Griffin is one of the world’s leading hedge fund managers. He is Citadel's founder, chief investment officer, and CEO, which has more than $35 billion in assets. In the last few years, he has been ranked as one of the best performers in the hedge fund industry.

Griffin sets a great example for traders, investors and businesses. Here’s what we can learn:

Age Is Not A Hurdle

One of the most important lessons we can learn from Kenneth Griffin is the value of starting early.

Griffin began his investment firm in college with very little money but a lot of interest in the financial world. He set up a satellite dish in his dorm room to get financial quotes, something we can easily do now with a computer and internet connection. He started investing his limited funds, and as he gained more money, he reached out to other investors who believed in him.

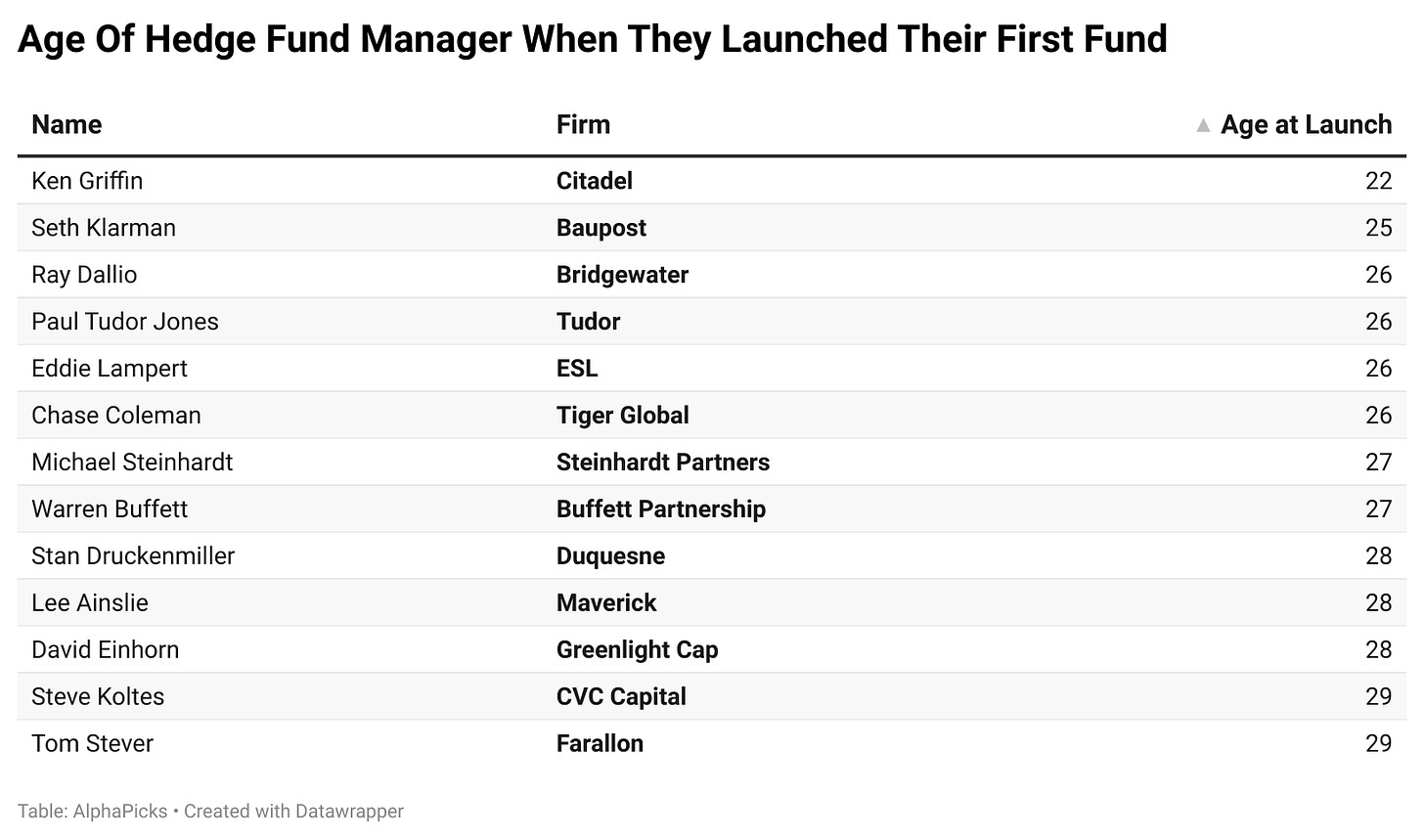

Griffin is one of the youngest to ever start a Hedge Fund at just 22. Regardless of your industry, if you apply yourself, age will never be a factor holding you back.

It's never too early to start investing, even if you have just a small amount of money. As you gain more experience and a positive reputation, you can attract more investors and further grow your investments.

It's important to note that nowadays, investing with just a little bit of money is easier than ever. Many platforms allow you to invest with as little as $10 and don't charge commissions or fees for trading. This means that investing can be relatively simple and accessible to anyone, regardless of their financial background.

Losses Are Inevitable

It's normal to experience losses in the financial market. It happens to everyone, even the most successful investors.

Back in 2008, Griffin lost a lot of money in a financial crisis. He once said in an interview that he was losing hundreds of millions of dollars every day. As a trader, you should know that not every trade you make will earn you money. Some will be profitable, while others may not.

The important thing is to learn how to handle your losses. Griffin was able to recover from his losses, and his fund is now doing better than ever.

If you avoid large losses with a strong defence, the winnings will have every opportunity to take care of themselves. And large losses are almost always caused by trying to get too much by taking too much risk.

Win big. Win small. Lose small. Never lose big.

Adapt

In any job you choose, you will experience changes. If you are trading or investing, you will find that this industry is constantly changing. For example, trading in the past is very different from trading today.

Griffin started his career by investing in a type of trading called “arbitrage”.

What is Arbitrage Trading? Arbitrage occurs when a security is purchased in one market and simultaneously sold in another market for a higher price. The temporary price difference of the same asset between the two markets lets traders lock in profits. Traders frequently attempt to exploit the arbitrage opportunity by buying a stock on a foreign exchange where the share price hasn't yet been adjusted for the fluctuating exchange rate. An arbitrage trade is considered to be a relatively low-risk exercise.

With time, he grew his fund to include, among others, one of the largest quantitative strategy firms in the United States. His firm, Citadel Securities, is also a leading broker which processes high frequency orders on a daily basis.

Adapting to change will help you become a better trader. Market conditions change all the time.

The Importance Of A Team

As a trader, you can decide to do it all by yourself or get a team. Each of these strategies has its own advantages and disadvantages.

In terms of Kenneth Griffin, he has invested a lot in having the best team. He pays his traders very well. Also, Citadel has been ranked as one of the best places to work in America.

The benefits of working with a good team create synergy. Synergy is an interaction or cooperation giving rise to a whole that is greater than the simple sum of its parts. It brings to mind the famous quote: “Two heads are better than one.”

Social trading has been constantly growing. There are now many ways to be able to share ideas and work together with those who are also interested in markets.

Diversify Incomes

Another important lesson you can learn from Ken Griffin is the need to diversify your income.

Although Griffin started his career as a hedge fund manager, he has diversified his business to include Citadel Securities, which is the biggest market maker in the US.

In fact, while his hedge fund is big, Citadel Securities has become the most valuable part of its business. In January 2022, the fund raised money at a valuation of over $22 billion.

The lesson? Relying on just the markets for income can prove challenging and may lead to poor decisions if the pressure to make money is high. Focus on creating multiple streams to diversify your income.

Quotes from Ken Griffin

“You can't succeed in the markets today unless you are part of a great team. The team is the essence of how you win.”

His success down to moving from being an individual trader to employing a huge team of specialists and working together.

“We think that excellence in investing comes from focus.”

Focus helps you stay disciplined, resist impulsive actions, and stick to your established trading plan. It allows you to avoid chasing after every market fluctuation and instead execute trades based on a rational assessment of the situation.

“The key to our business, it's a lot of research.”

Citadel carries out a huge amount of research and employs specialists in a variety of fields. Needless to say, Ken Griffin believes in research.

In case you missed our research this week:

It's Time For Meta To Grow Up As It Turns 20

Over the past couple of weeks, Meta has popped into our news feeds for several different reasons. The links between some of them are tenuous at best, but we thought the time was right to offer our views on the company, the share price and where we see it heading in the future.

India's Stock Market Boom

For several decades, markets made bets on China being the world’s biggest growth story. But as China’s economy falters, India has emerged as the prime investment destination. However, global investors' desire to own a piece of the emerging world's brightest market has led to an underestimation of its vulnerability and risks.