The Pendulum Swing

Quickly forgotten, but present as ever.

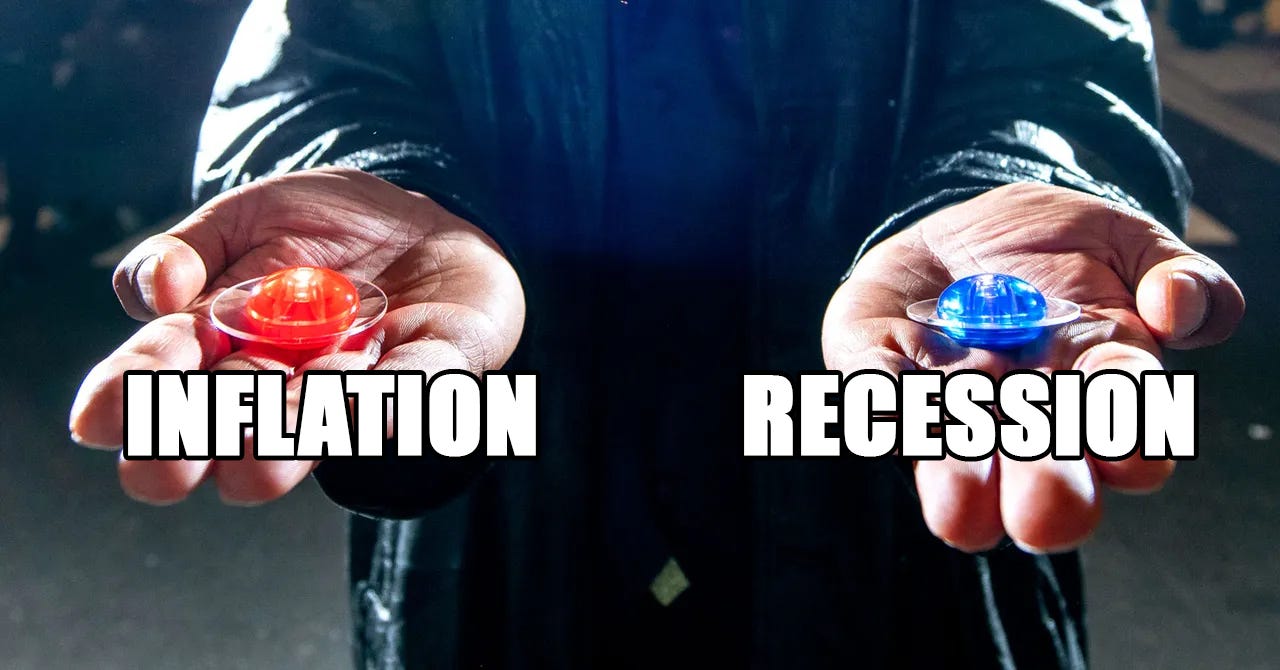

The start of August presented us with a pendulum swing: No longer were markets worried about inflation. Recession was now the primary concern.

The shift happened quickly across two events. In their July 31st meeting, the Fed welcomed a September cut, acknowledging “some further progress” toward their inflation goal.

On Friday of that week, US hiring slowed markedly for July, and the unemployment rate rose to an almost three-year high, raising recession concerns. Markets dropped 1.84% in the final session of the week.

A quick turnaround, to say the least.

However, fear of a recession looks overdone, but inflation risks are possibly underpriced at current yield levels. More on that trade idea later.

Globally, central bank focus has been towards inflation and bringing it back under control. The Federal Reserve continue to emphasise its 2% goal. However, we put forward our thoughts on why ‘3% is the new 2%.’

Now, they’re going to pivot and focus a bit more on the labour market. Investors will look for clues on how the Fed is managing that balance when Chair Jerome Powell and others speak at the central bank symposium in Jackson Hole.

The Recession Turnaround

Let’s put aside the headlines and look into what happened—how the recession story actually shifted.

Markets began to price the odds of a recession slightly higher. Don’t confuse that with the markets pricing a recession as the primary outcome (even though it may have sounded like that in the headlines).

Now, keep in mind that this was based on one data print on August 2nd. Since then, retail sales have been stronger, and jobless claims have been lower.

This has caused an adjustment to the above 12-month recession probability. Pricing now looks like this:

Inflation Stagnation

The last mile in the battle against inflation is the hardest one.

Outside the US, price data from several developed countries remains stubbornly high. Australia has indicated that a rate cut in the next six months is unlikely due to inflation sitting at 3.8%, and euro-area inflation accelerated unexpectedly in July. Barclays strategists suggest using short-dated swaps to prepare for increased euro-area inflation in the coming year.

While recent data has shown progress in the US, some potential headwinds remain.

With the US presidential election drawing closer, a near-term crunch point may arise if Donald Trump is elected. Trump is advocating for tax cuts, tariff increases, and immigration crackdowns, all of which have the potential to generate inflationary pressures.

So… What’s The Trade?

Rather than a consensus trade, we’re putting this article together to present our ideas about the potential of rising inflation. It is one to come back to in the future should the trade be needed, but one to understand now to be prepared.