Top Trade Ideas - April 28th

Reprieves are cheap. Repair is expensive.

Price action last week suggested a reversion to the standard risk-on playbook, following the initial volatility shock tied to the Trump 2.0 policy rollout.

The rally gained momentum amid confirmation that Fed Chair Powell would retain his position, softer rhetoric around U.S.-China tariffs, and a broadly constructive start to earnings season.

Market internals confirmed the strength of the move, with the Zweig Breadth Indicator triggering for just the 18th time in the past 80 years, a historically robust signal, activated only when the percentage of advancing stocks vaults from below 40% to above 61.5% over a 10-day window. Participation was broad-based, leaving underlying breadth dynamics skewed decisively to the upside.

Although we aren’t sitting here believing that the Zweig Breadth Indicator is the saviour markets need. It’s more of an interesting observation that many created a lot of noise about last week.

While the tariff landscape, on a static basis, remains materially worse than what was priced as the “worst-case” scenario only a month ago, short-term operators are forced to respect the signal embedded in cross-asset risk metrics.

Risk appetite and liquidity conditions remain supportive, suggesting that risk assets can continue to grind higher in the near term, irrespective of structural or fundamental headwinds that may ultimately define the longer-term path.

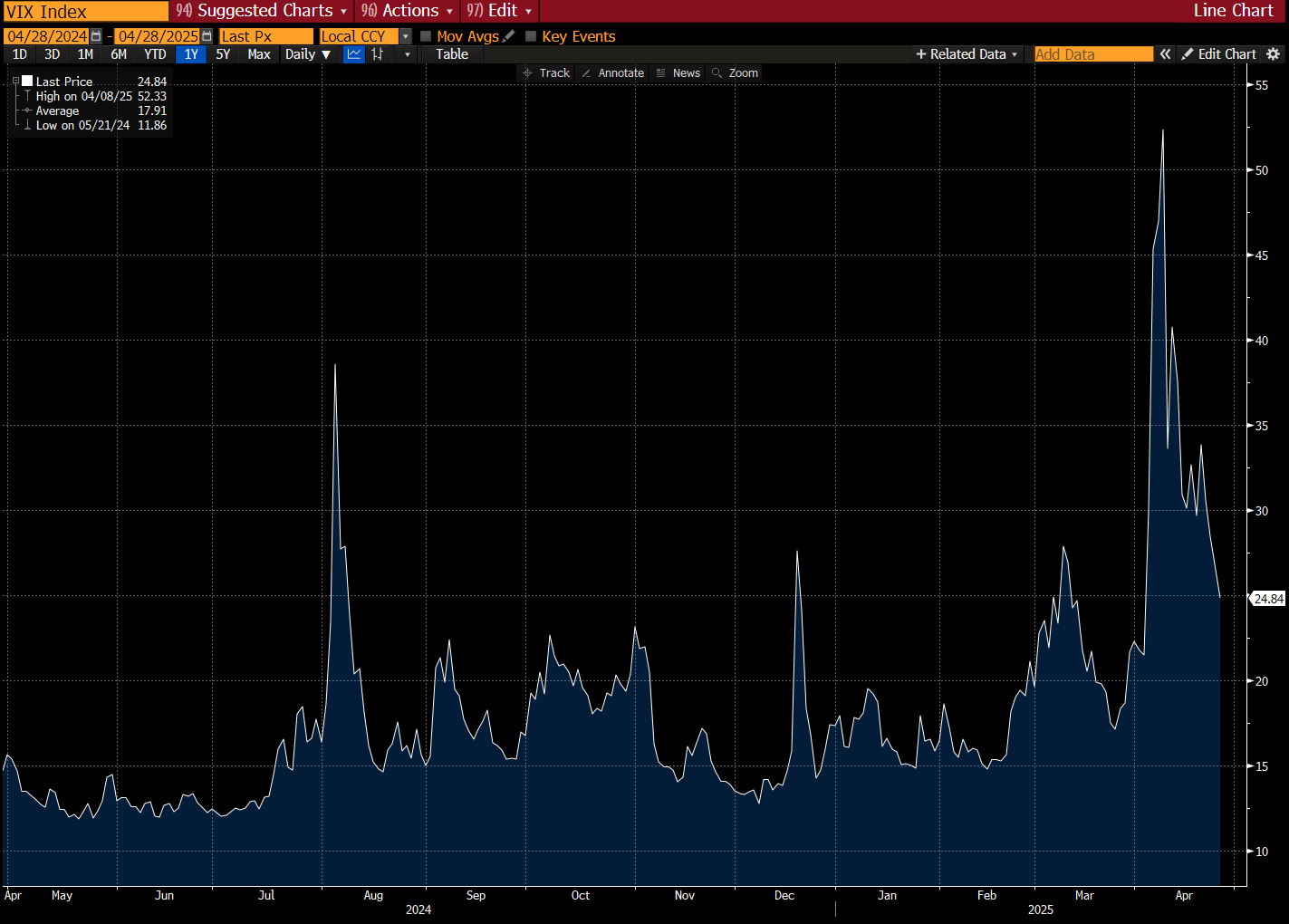

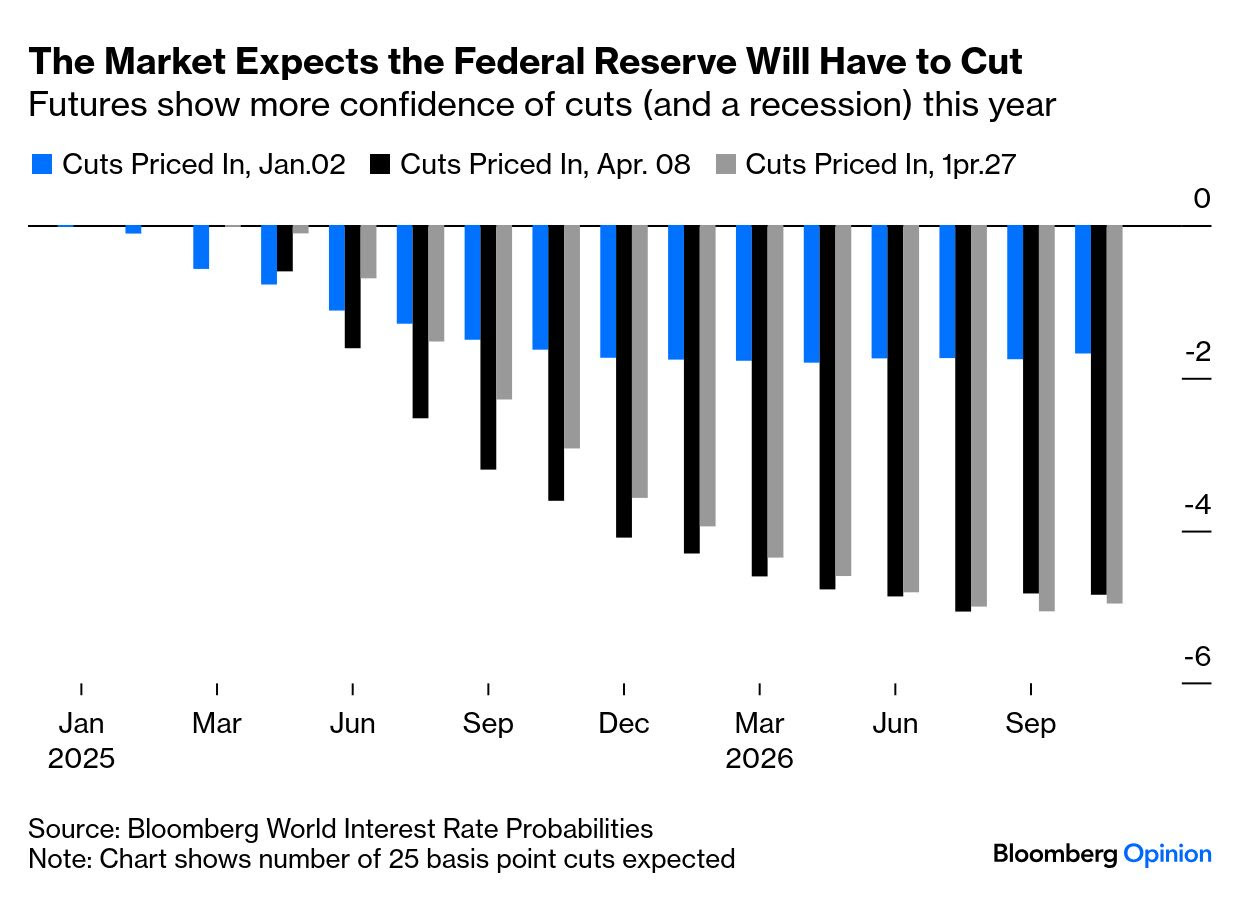

Some shifts have proven more persistent, starting with Fed policy expectations. The chart highlights the evolution of priced-in rate cuts—from year-end levels, through the April 8 peak in market stress ahead of Trump’s tariff delay announcement, to today.

Markets are now discounting a materially more aggressive easing path than they were before Trump’s re-election. While the tariff reprieve has moderated expectations for imminent emergency cuts, the broader assumption of a lower policy trajectory remains intact.

(In case you missed it over the weekend, our latest primer on the cross-currency basis trade was released. You can read it here.)

Become a premium subscriber for full access to articles.

The Week Ahead

Markets will closely watch the first estimate of U.S. first-quarter GDP on Wednesday, which could reveal early damage from tariff uncertainty. Weak growth could reinforce expectations for Fed rate cuts later this year. April jobs data on Friday will also be critical, following strong March numbers. Additional labour market signals will come from JOLTS openings, ADP payrolls, and weekly jobless claims.

Key inflation and confidence indicators are also due: March PCE inflation, April ISM manufacturing, Conference Board consumer confidence, and February Case-Shiller house prices.

In Europe, attention turns to first-quarter GDP and flash inflation figures. Spain reports on Tuesday, followed by France, Germany, and the eurozone on Wednesday, with the eurozone inflation print on Friday. Business and consumer confidence surveys will round out a busy week.

Asia’s focus will be on the Bank of Japan’s policy decision and a batch of Chinese economic data as the region gauges trade war impacts.

In Canada, GDP data for February is released on Wednesday, while the country’s general election on April 28 could bring political volatility.

Investors will also monitor for any signs of progress in U.S.-China trade relations, which have been a major source of recent market turbulence.

Indices

Last week’s rally reflected a classic counter-trend correction, as positioning and sentiment overshot an evolving narrative. The durability of this rebound now hinges on the policy trajectory and the market’s read-through.

A full rollback of the announced tariffs, a renewed diplomatic channel between Washington and Beijing, re-engagement with European allies, and reinvigorated support for Ukraine would materially alter the macro landscape. The recent tone shift in political signalling makes such an outcome marginally more conceivable. Additional fiscal stimulus (via renewed discussion of tax cuts, which Trump is wisely reintroducing) would further catalyse risk sentiment, although it would damage the bond market.

Ultimately, market participants must assign their own probabilities to this scenario. Political realities present significant friction: Trump’s aversion to admitting missteps complicates the path to a clean reversal. Meanwhile, prevailing sentiment, particularly ex-U.S., but increasingly within Wall Street itself, suggests a line has been crossed regarding trust in U.S. policy credibility. It is debatable whether even an optimal outcome could fully restore it.

For now, we remain neutral on U.S. indices and will focus our attention elsewhere. Liberation Day levels will be on watch for us with any move to the upside.

Foreign investors have turned net buyers of Indian equities in April, reversing earlier outflows as markets bet India will remain relatively insulated from U.S. tariff shocks. Global funds bought Indian equities for the seventh straight session through April 24, bringing this month’s inflow to $91mn. The purchases reversed outflows of as much as $3.2bn earlier in the month.

As the U.S.-China trade war escalates, India’s relative resilience is drawing attention. MSCI India has fallen less than half as much as the broader Asian benchmark since the April 2 tariff announcement, while local bonds have remained firm on central bank liquidity support. India’s domestic-facing economy, conciliatory trade stance with the U.S., and potential gains from supply chain shifts are enhancing its appeal.

Economics sees only a modest 0.3-0.4pp downside to India’s FY26 GDP forecast, and Jefferies has upgraded India to overweight in Asia portfolios. Strong domestic investor flows, Prime Minister Modi’s capex push, and RBI policy easing have further cushioned the market.

However, some caution remains: sectors like software and pharmaceuticals are more exposed to external shocks, and valuations are still elevated versus regional peers. Still, the consensus view is that India is positioned as a relative outperformer amid global trade tensions.

Getting long SENSEX at 80,000

FX

The mix of Trump walking back his comments on Powell, alongside China tariff aggression, finally meant the USD could catch a bid and move off the recent lows versus many G10 counterparts. The Mich sentiment data from Friday also provided a bright spark.