Top Trade Ideas - January 27th

DeepSeek creates concerns for Western tech.

Inauguration week didn’t bring the expected volatility to equity markets, but in the world of FX, tariff twists caused some turns in dollar pairs.

“Drill, baby, drill” was the main headline in the string of executive orders. The President vowed the U.S. will embark on a new age of oil and gas exploration. The desire is clear to help ramp up fossil fuel production levels. The knock-on impact is for higher exports alongside rapid job growth, fueling economic growth.

The tech stories from last week centred around DeepSeek. Founded by hedge fund manager Liang Wenfeng, the company released its R1 model on Monday, explaining in a detailed paper how to build a large language model on a bootstrapped budget that can automatically learn and improve itself without human supervision. It has sent some shockwaves around the perceptions of AI costs, coming in well below the costs of other companies like OpenAI.

There have been many opinions shared on what this means for AI costs, the U.S.-China tech war, and the road going forward. We think it’s a bit too early to have many high-conviction takeaways, although we see this as being another catalyst for China semiconductor names. Nasdaq futures are down 2.4% as we head into the London open.

Eurostoxx continued its outperformance to American peers as the U.S. exceptionalism train continued a slower start to the year than anticipated.

The Week Ahead

The Federal Reserve is set to announce its rate decision on Wednesday. Given the evidence of a robust U.S. economy, it’s anticipated (FedWatch 97.9%) that interest rates will remain unchanged for the time being. Attention will be paid to any hints regarding potential future cuts to the interest rates and the timeline for such actions.

At present, U.S. money markets are pricing in nearly two rate reductions later this year, with the first cut not expected until June. Fed Chair Jerome Powell may sound less cautious about future rate cuts than his remarks from December’s meeting, though it’s unlikely he will convey an urgent need to start easing policy.

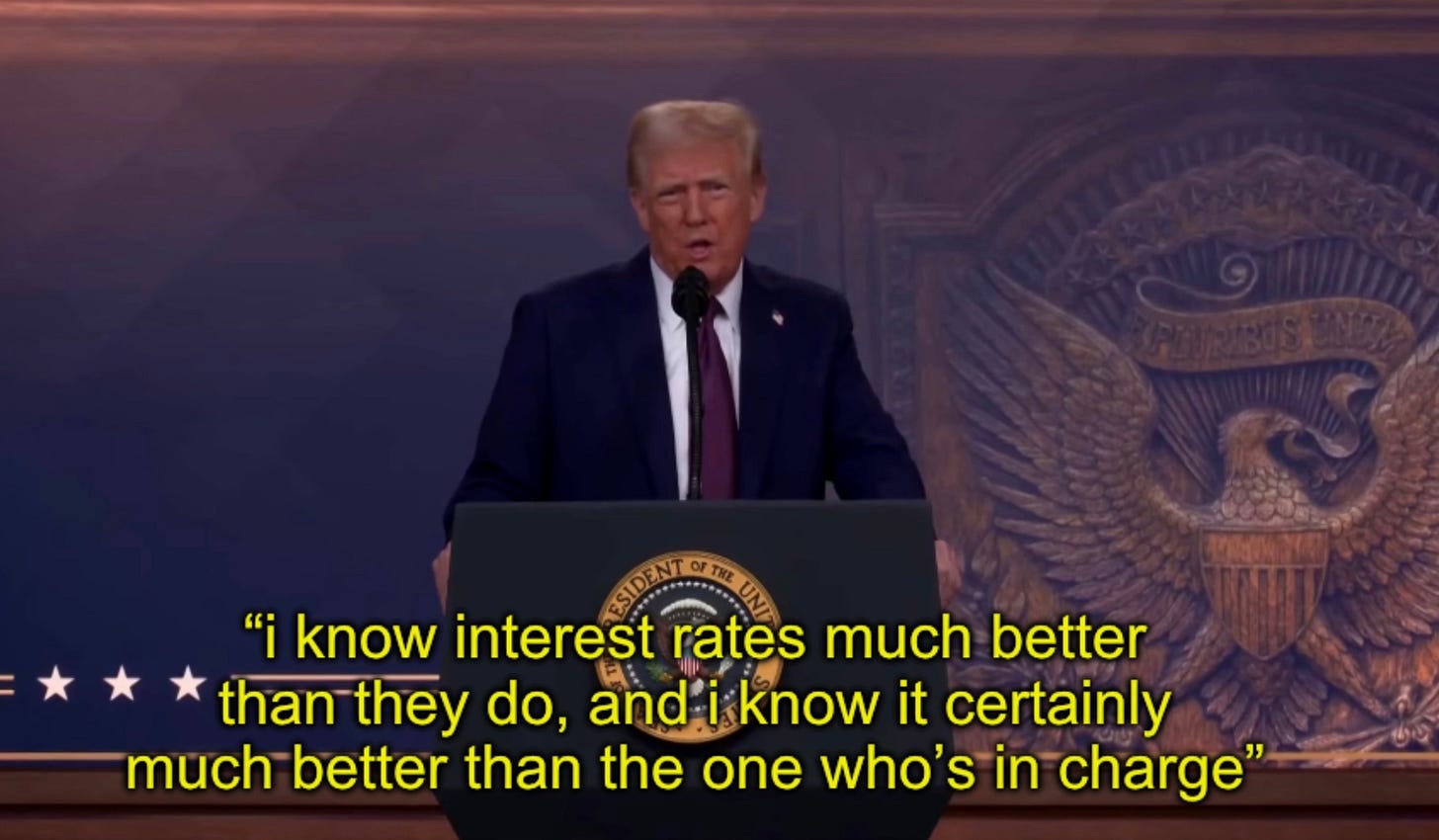

We’re also keen to hear the Fed’s perspective on inflation, labour market conditions, and interest rates in light of President Trump’s policy agenda, especially since he has expressed a preference for lower rates.

We’re also keen to hear the Fed’s perspective on inflation and labour market conditions, as well as replies to Trump’s commentary last week demanding lower rates. However, we can assume that Powell will tread lightly and have a very diplomatic response in his presser.

We’re not usually coming with the memes on Monday, but this sums up every macro commentator in the coming days:

In terms of economic indicators, the preliminary gross domestic product data for Q4, due on Thursday, is expected to confirm that the U.S. economy has remained strong. The U.S. economy has been growing at an impressively stable rate of between 2.5% and 3% per year for the past two and a half years, and this is unlikely to have changed in the last quarter.

On Friday, data on PCE inflation—the Fed’s favoured inflation measure—could suggest a higher likelihood of rate cuts if it reflects a moderation in inflation. Expectations are for a relatively modest increase in the PCE figures, coinciding with indications of easing wage pressures as the fourth-quarter employment cost index is released the same day.

As will be the case for a few weeks to come, any updates from Trump regarding policy plans, particularly concerning the extent and timing of tariffs on goods from Canada, Mexico, and China, will be watched widely.

The European Central Bank’s first meeting of the year draws significant attention, with a widely anticipated 25bps cut in interest rates as the eurozone economy continues to face challenges in its recovery. This decision is set to be announced on Thursday. Let’s see what insights ECB President Lagarde has to offer about the 2025 path.

If you are not yet a premium subscriber to AlphaPicks, you can access a free trial here.

FX

In FX, it pays to be flexible and adjust your view in response to the price action. The back end of last week showed us that a peak in the DXY might be in, with clear technical breaks in the likes of EUR/USD.

From a fundamental view, Trump said in an interview on Thursday that he would rather not have to use tariffs on China. He also spoke about a preference for lower interest rates, with his desire to meddle in monetary policy matters something we spoke about last week here.

The bearish trend in EUR/USD that started in Q4 last year has been broken, and we expect a continuation of this pop higher in the coming couple of weeks. The FOMC and ECB meetings this week are a risk event, so we go to the Options space instead of trading this at spot.

We cut our target of parity in the near term, and based on some conversations we’ve had, it could be a case that we hit peak Europe pessimism earlier this month.

TRADE IDEA - EUR/USD HIGHER

Buy a 2 week 1.0600 strike put costing 0.25%, targeting a fast move higher.

Another pair with a similar setup to EUR/USD is GBP/USD. Below we show the daily candle chart, which shows the extent of the move higher last week.

It’s true that we’re less confident in being long GBP from that leg of the trade, but we can’t ignore the technical picture here.

With the option play on EUR/USD, we choose a more aggressive spot play here.

TRADE IDEA - PLAY THE BREAK ON GBP/USD

Entry: 1.2480

Take Profit: 1.2790

Stop Loss: 1.2345