Top Trade Ideas - July 14th

30% was the opener. Now comes the walk-down between Brussels and Washington.

Markets wobbled, ending the week in the red as tariff theatrics returned to centre stage. The S&P 500 dipped 0.3%, the Dow shed 1%, and while the Nasdaq held firmer, a cautious tone crept in. Summer volumes and thin liquidity added to the chop, but under the hood, some sectors found their footing. Energy rallied 2.5% as OPEC+ hinted at pausing production hikes, and airlines caught a tailwind after Delta lifted its profit outlook, citing resilient demand and a public now “numb” to trade noise.

The White House floodgates opened on Monday, with Trump sending a barrage of tariff threats, from a 25% levy on Japan and South Korea to a bruising 50% shot at Brazil, all wrapped in executive delays and Truth Social proclamations. Copper imports will face a 50% duty starting August 1 (comments on this below), and pharma might be next. Over the weekend, we received news of Mexico and EU tariffs being set at 30%, the latter being the most impactful figure that participants were waiting for. The tariff calendar is filling fast, and so is investor fatigue to it.

Economic data was quiet, but Fed chatter picked up. Waller flagged that policy may now be “too tight,” hinting at his vote for a July rate cut. Daly backed two cuts this year. Still, OIS markets remain anchored to an October-December timeline, leaving room for repricing, and maybe another leg higher for equities.

Treasury yields crept up, with the 10-year finishing 6bps higher on light unwinds of risk. The dollar ground higher all week, pulling EUR/USD back below 1.17. The setup into earnings season is classic: low expectations, light positioning, and no shortage of political noise. Buckle up.

Nikkei shorts from last week played out well following the announcement of the tariff rate, as well as our GBP/USD trade, as our focus turned to some short-term dollar strength. CL ticked up higher as we stay on watch for a short. Defence names remained strong, with Macron announcing on Sunday night of increased spending within the sector.

(To get full access to all research and notes posted, subscribe to premium.)

The Economic Week Ahead

Markets enter the week with focus squarely on US inflation and Chinese GDP, two prints that will shape global rate expectations and growth sentiment. With the clock ticking toward the August 1 tariff deadline, any escalation or delay in US trade actions will also carry weight for cross-asset risk appetite.

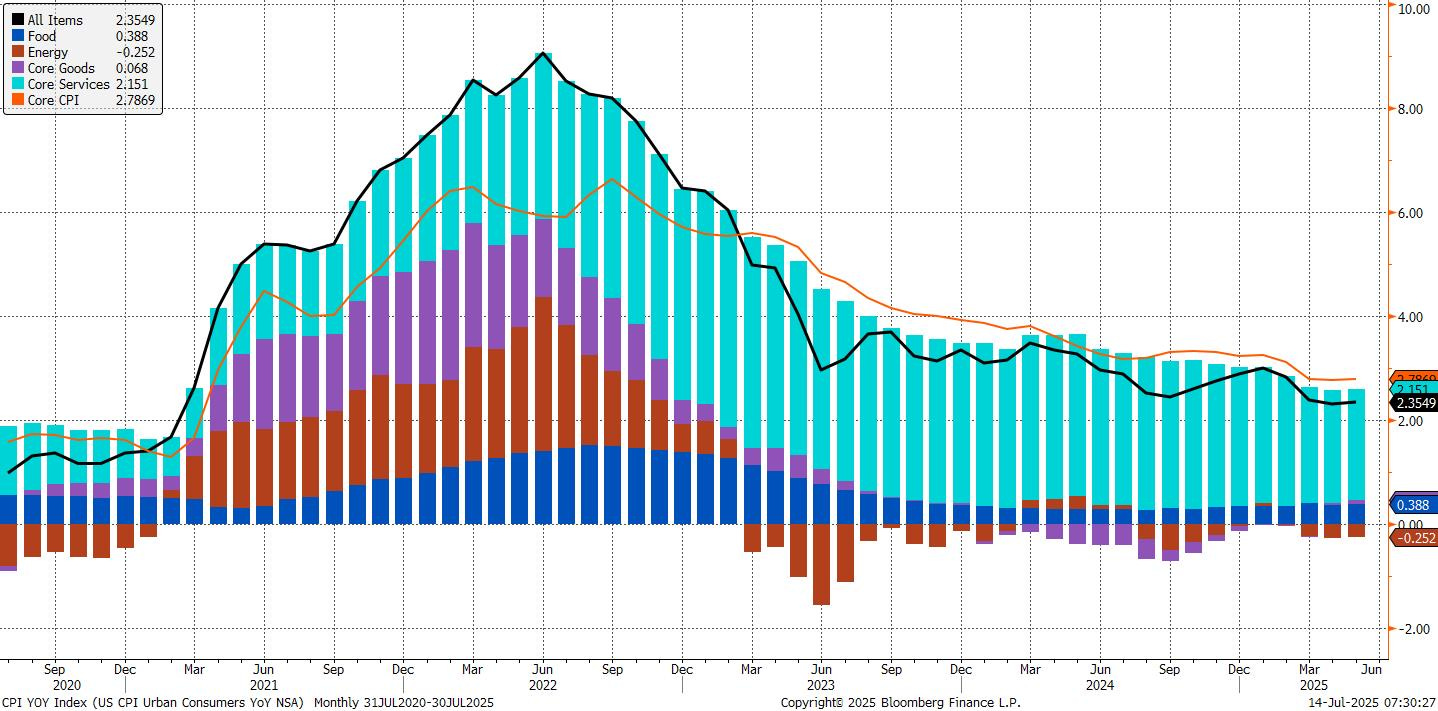

In the United States, Tuesday’s CPI print is the key event. Economists expect modest upward pressure from base effects, though housing and labour softening could offset core stickiness. A cool reading could reopen July cut discussions (currently priced at <7%), while anything hot likely pushes the Fed to wait until September or later. PPI, retail sales, industrial production and the University of Michigan survey follow later in the week. With markets already leaning dovish, a downside inflation surprise could see rate cuts pulled forward.

In China, Q2 GDP drops on Tuesday and is expected to show 5.2% year-on-year growth, a slight slowdown from Q1. Investors will be watching not just the headline, but also retail sales and industrial production for signs of domestic traction. Monday’s trade data showed resilient exports but weak imports, consistent with a lopsided recovery. Housing figures will be crucial; continued price declines could prompt another stimulus round. The question is whether 5% growth is real or a residual policy illusion.

Over in the Eurozone, the final HICP data for June land on Thursday, with core expected to remain above target. With the ECB’s next cut not fully priced until September, any upside surprise could push that further out. ZEW sentiment and industrial production will provide additional read-through on trade-sensitive sectors. Watch German auctions midweek for any signs of demand stress amid duration repricing.

The focus in the United Kingdom is Wednesday’s CPI print, which is expected to hold steady at 3.4%. With the economy contracting again in May and labour markets softening, the BOE may soon feel pressure to accelerate its easing path. Jobs and wage data on Thursday will be key. Markets are already pricing a 78% chance of an August cut. The bar for further delay is rising.

Japan’s June CPI on Friday should confirm still-sticky inflation, with core expected at 3.4% y/y. Trade data on Thursday may show further weakness in exports. With the BoJ reluctant to move ahead of a clearer US direction, it’s unlikely this week’s data changes the near-term outlook, but any upside inflation surprise could shift market expectations for a second hike into the fall.

Macro/Rates

Fading the Fed Cut Tail with SR3 and ZB Shorts:

Markets are aggressively pricing in tail risk scenarios of deep Federal Reserve cuts into late 2025, despite a macro backdrop that doesn’t yet justify such moves. As our WOTS pointed out, nearly 20% of the probability distribution is priced for cuts of 50 basis points or more by September and 100 basis points or more by December. This implies a market narrative built on downside protection rather than data-dependent reality. Inflation remains sticky (core PCE is running at 2.7%), and core goods inflation has begun to rebound. Meanwhile, labour market indicators are stable and not flashing recessionary warnings. The Fed itself has communicated patience, not panic.

Against this backdrop, we like a trade that fades the high pricing of near-term easing while also expressing a bearish view on the long end of the curve if inflation data stays warm or surprises hot. Specifically, we think shorting the SR3Z25/SR3Z27 spread and also shorting ZB works well. This dual expression reflects a core conviction: that the market has overreacted to near-term downside fears, and is underpricing the possibility of policy inertia well into 2026.

If inflation data remains firm, that spread should widen as the market reprices the pace and timing of Fed cuts.

Risks to the trade include a sudden deterioration in labour market data, an unexpected geopolitical shock, or a significant dovish pivot from the Fed, potentially triggered by a soft CPI or payroll print.

FX

Hold tactical USD longs:

Last Monday, we put out a tactical short GBP/USD put spread idea at 1.3650, with the pair closing last week at 1.3493. We outlined further reasons for a short-term rebound in the greenback here, which likely has legs to keep going in the coming weeks.

For those who didn’t get involved last week, the pair could break below the 50 DMA, which has acted as support on several occasions so far this year. This would allow for a swift move down towards the 100 DMA at 1.3251. Although we’re careful not to have too much long USD exposure on the book, the risk/reward does stack up well even at spot here.