Top Trade Ideas - June 16th

A week of rate cuts, war headlines, and trades that reward strong nerves.

The S&P 500 ended the week marginally lower, down 0.39%, after Friday’s geopolitical shock erased prior gains. Markets opened sharply lower following reports of Israeli strikes on Iranian nuclear facilities, sparking a surge in crude prices and a rotation into energy stocks. Energy was the standout performer on the week, gaining 5.7%, while defensive sectors such as health care and utilities also outperformed.

Earlier in the week, May CPI and PPI data came in below expectations, reinforcing the disinflation trend and supporting a midweek equity rally. Despite ongoing tariff threats from President Trump, including plans for unilateral rate-setting via letters to trading partners, markets were largely unmoved, indicating a shift in sensitivity to trade policy relative to earlier this year.

Tech sentiment was mixed. Tesla rebounded 10.2% as Elon Musk softened his rhetoric following his feud with Trump. Apple’s WWDC failed to excite, while Adobe and Oracle saw diverging reactions to AI-related narratives. Consumer names struggled, with Smucker plunging on tariff-related margin pressure.

US Treasuries rallied after the inflation data, pushing 10-year yields down over 6.5bps. The dollar weakened to its lowest since 2022, reflecting dovish repricing.

(To get full access to all research and notes posted, consider becoming a premium reader here.)

The Economic Week Ahead

All eyes will be on the Federal Reserve’s rate decision this week. The Fed is widely expected to hold rates steady, but softer inflation data have pulled market expectations for the first rate cut forward to as early as September. Fed commentary will be closely scrutinised for clues on how policymakers are weighing cooling price pressures against sticky labour market data and rising geopolitical risk. Oil’s recent rally, driven by escalating Israel/Iran tensions, threatens to re-stoke inflation fears and complicate the path to easing.

US retail sales, industrial production, and housing data will add texture to the domestic growth picture. At the same time, Treasury auctions, including a 20-year bond and 5-year TIPS, will test investor appetite as yields remain sensitive to deficit and supply concerns.

In the UK, the BoE is expected to leave rates unchanged, though Wednesday’s inflation print will be crucial for determining whether a summer rate cut remains in play. Data showing a soft April GDP and rising unemployment have raised pressure on the BOE to ease sooner, with markets now pricing in a cut as early as August. We shared our thoughts on this last week. The Treasury’s spending review and retail sales data will round out the UK focus.

In Europe, a light data calendar leaves attention on German producer prices and second-estimate eurozone inflation. With the ECB already cutting last week, investors are watching to see how soon the next move might follow. Meanwhile, tensions in energy markets may reframe the inflation narrative and challenge dovish assumptions.

Several G10 central banks are also in focus. The SNB is expected to cut rates again, possibly taking them below zero, while Sweden’s Riksbank may join the easing cycle depending on recent inflation and growth data. Norway’s Norges Bank, by contrast, is expected to stay on hold.

In Asia, the BoJ is likely to keep policy steady, though markets will watch closely for any signal of changes to its JGB purchase plans. With inflation picking up and trade data softening, Japan’s economy remains caught between external headwinds and domestic stimulus. China will release key industrial output, retail sales and housing data Monday, with markets looking for confirmation of a mild growth slowdown as tariffs and weak external demand drag.

Rate decisions are also due from India, Indonesia, the Philippines, and Taiwan. Most are expected to stay on hold or ease, depending on domestic inflation trends and sensitivity to Fed policy timing. New Zealand’s Q1 GDP will gauge whether the economy’s recovery has traction, while Australia’s business sentiment data could firm up expectations for another RBA cut in July.

As rate divergence widens, oil volatility increases, and trade policy uncertainty lingers, global markets remain locked in a delicate recalibration between growth, inflation, and central bank tolerance for risk.

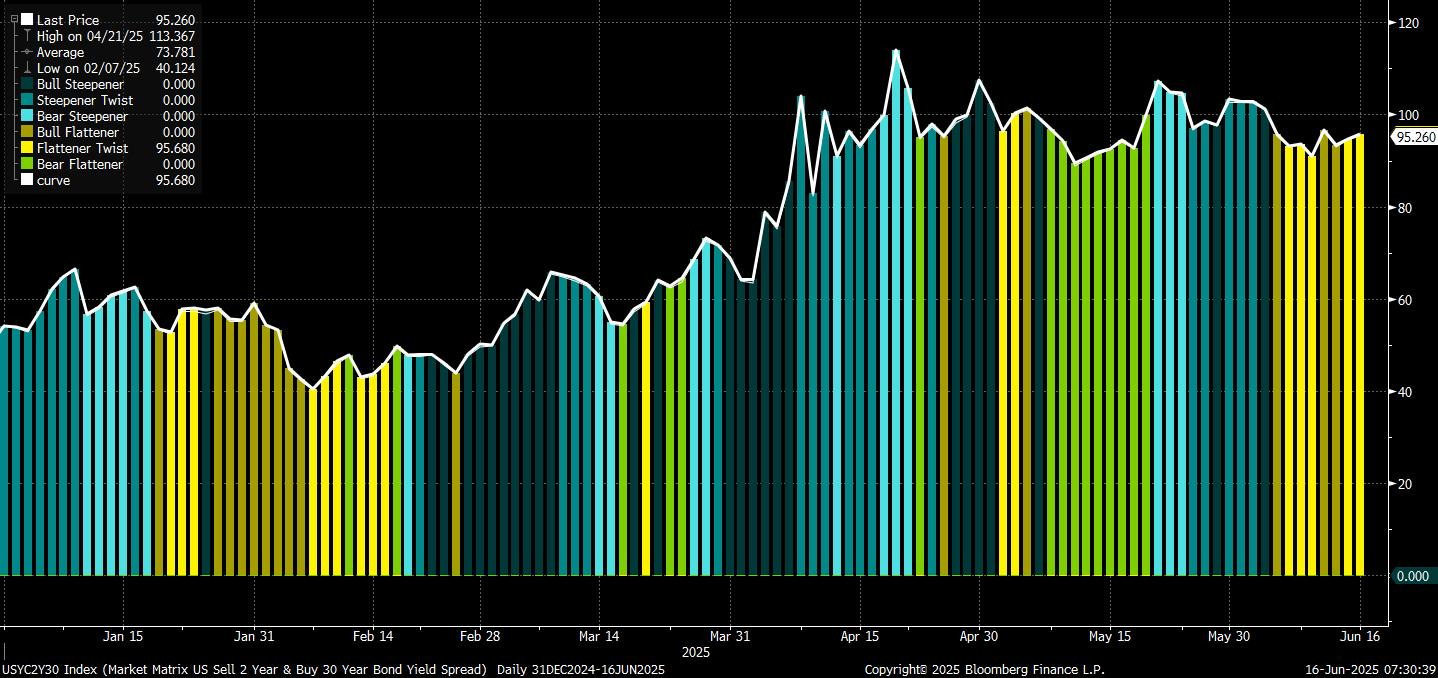

2s30s Steepener

Let the long end reprice the risk:

Bond markets want to believe in soft landings and stable auctions. But the reality looks shakier. A solid 30-year auction gave bulls cover, yet yields rose at the long end. The “safe haven” impulse failed again, even with Middle East tensions and softening data. This is a market re-rating term premium, one failed auction at a time.

The front-end, meanwhile, remains anchored by rate expectations that have already repriced higher. There’s now more upside to renewed cuts than hikes, and Fed pricing is already leaning more hawkish than dovish, but we will have to see what the updated “dot plot” says. A surprise slowdown, softer CPI, or geopolitical hit would revive cut bets and pull 2-year yields lower.

The steepener trade isn’t new, but it’s not done. Positioning has cooled off, auctions are set to test long-end demand again (20-year on Monday as mentioned before), and inflation anxiety is increasingly focused on the term premium, not the short rate path.

The move: Initiate 2s30s steepeners here (~95bps). You’re positioned for front-end stability or modest rally, and long-end weakness if auction demand slips or inflation risk builds. Add if the 20-year tails, especially if 10s and 30s start to disconnect from risk sentiment again.

Target: 2s30s toward 110bps-115bps. Stop out on a clean 20y auction and renewed recession fear, the only true threat to long-end supply pressure.

The bond market isn’t trading data right now. It’s trading buyers, or the lack of them.