The Year of Opportunistic Selloffs

How much longer that will last seems less and less certain.

The current sentiment among stock investors remains remarkably resilient, with many jumping in to buy on the pullbacks triggered by the DeepSeek drama, alongside the ongoing concerns about trade tariffs and the January CPI print.

Despite enduring two tough Mondays that hit the markets hard (Jan. 27 and Feb. 3), momentum in stock benchmarks stayed strong. This confidence among investors has pushed equities to a point where they appear somewhat stretched by certain measures. Indexes are edging back toward their recent peaks, and in many cases, they’re hovering near ATHs. Equity benchmarks from Hong Kong to Germany are either near or have already entered overbought territory.

The recent intraday pullbacks following the DeepSeek shock and Trump’s trade initiatives did not lead to lasting declines. The deeper correction that many anticipated after the Fed shifted its stance on rate cuts in December has not come to pass—the S&P 500 only declined 4.6% from the day prior to that meeting and the YTD low in early January.

For full access to all articles, consider upgrading to paid.

Retail Are Looking at Selloffs Opportunistically

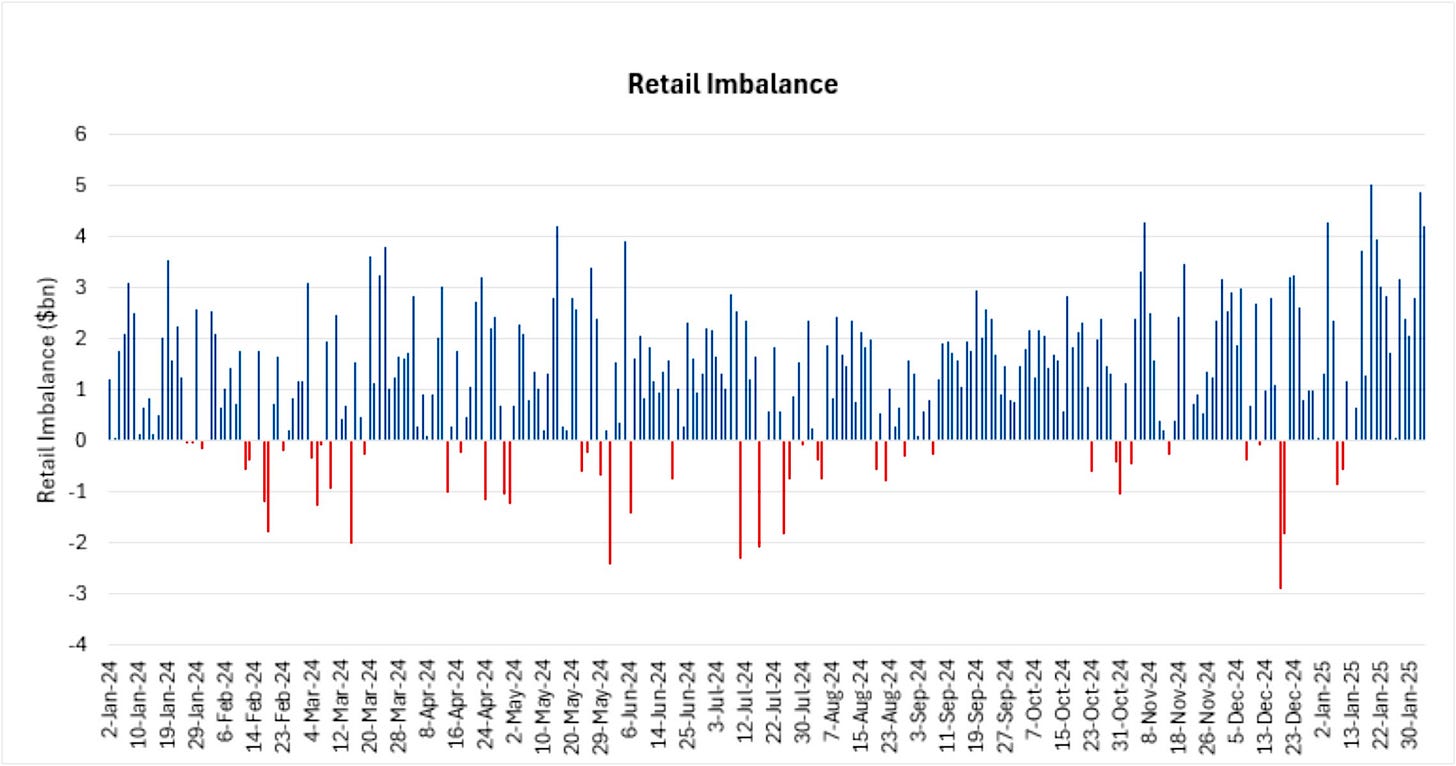

Retail investors are helping to drive the market, as the imbalance in buying surged to nearly $5bn on Feb. 3. This was quickly followed by another wave of buying at $4.2bn on Feb. 4. Notably, four out of the five largest retail imbalances were recorded this year, something that we raised in our latest WOTS article. This raises questions about how sustainable this trend can be.

There is a competition for dip alpha, and retail have been pushing around institutional investors given the rally and inability to break lower in equity spot prices.

We’re not here to say that we’re turning bearish right now, but our gut says that positioning is getting full on the long side, and we are turning toward a more cautious approach.

As far as the Trump-induced dips to the market, the effect is dwindling. We’ve seen selling into the Friday close a few times in the last weeks, likely a deleveraging before a weekend that could see an array of geopolitical events occur (JD Vance and Europe were the headlines this weekend just gone). It all feels like the boy who cried wolf: the first few weeks of Trump trading were volatile, but market participants have quickly grown comfortable with this new dynamic and have called Trump’s bluff on his rhetoric.

Retail traders have already boosted their allocations to U.S. stocks to one of the highest levels in more than two decades. Historically exposure levels are well correlated to economic activity—as you would expect—but this somewhat decoupled last year as a normalisation in the economy did not see any material retail outflows; the opposite in fact.

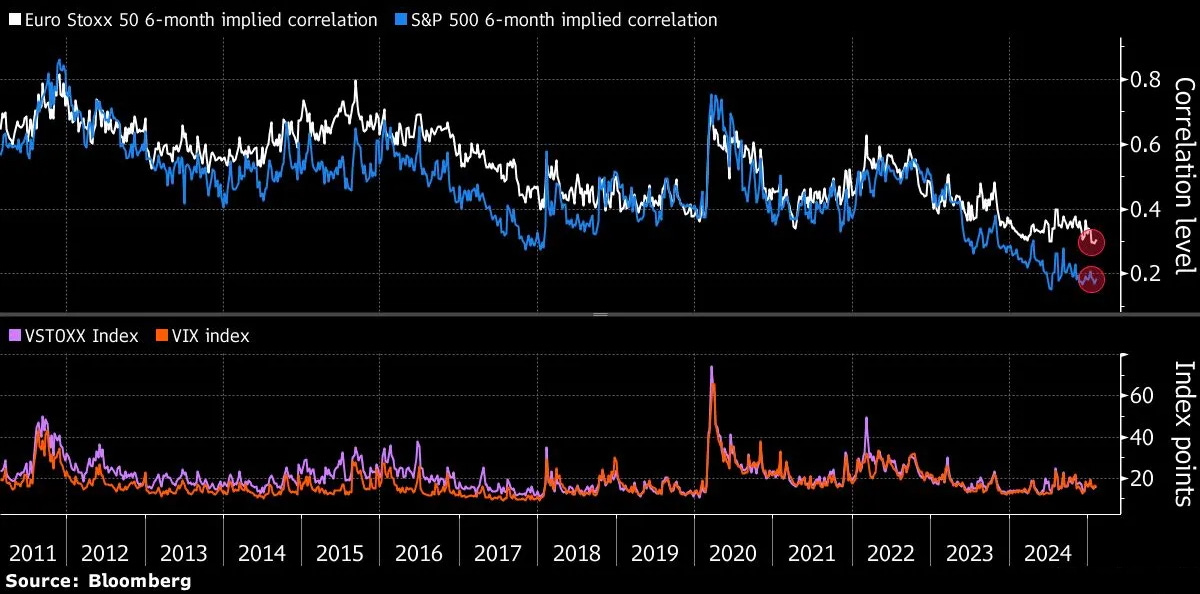

The correlation between stocks within benchmarks on both sides of the Atlantic is at an all-time low, meaning that any market shock is often seen as an isolated event, impacting just a specific sector. While this phenomenon has kept volatility in check, it’s unlikely to last, particularly after the earnings season wraps up.

Do the patterns in markets signal complacency? Probably not. Institutional investors have hedges in place, so that contained market drops don’t trigger any red lights in risk management departments. There’s evidence of this positioning in the relatively steep skew, elevated VVIX and earlier demand for upside in volatility through calls.

Volatility sellers received a scare from the AI and tariff drama in the past two weeks. Should this influential group start selling again, volatility will fall and further stabilise the market. In the short term, we might be getting a “volatility bleed” as the market numbs or shrugs off the worst macro fears.